Life Insurance Beneficiary Designations: Avoiding Mistakes

Travel Insurance Exclusions What You Need to Know

Travel insurance is designed to protect you from unforeseen events while traveling, but it's not a magic shield that covers everything. Policies come with exclusions, which are specific circumstances or situations for which the insurance company won't pay out a claim. Understanding these exclusions is crucial to ensure you have realistic expectations about your coverage and can make informed decisions about the right policy for your needs. This guide dives deep into common travel insurance exclusions, explaining what they are, why they exist, and how they can impact your trip. We'll also explore specific product recommendations and comparisons to help you choose a policy that minimizes your risk and maximizes your peace of mind.

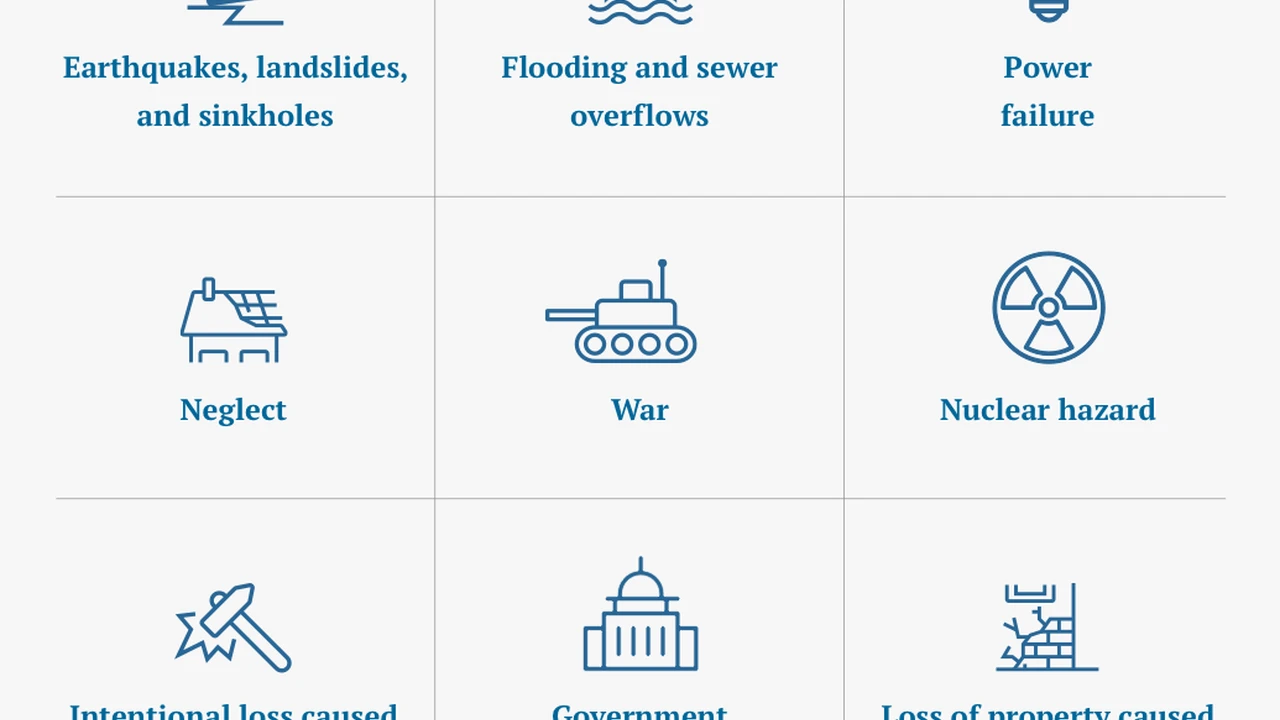

Common Travel Insurance Exclusions and Their Impact on Your Trip

Let's break down some of the most frequent exclusions you'll find in travel insurance policies. Knowing these inside and out will help you avoid nasty surprises later on.

Pre-Existing Medical Conditions and Travel Insurance Policy Limitations

This is a big one. Most standard travel insurance policies exclude coverage for pre-existing medical conditions unless they are specifically waived or covered under a special rider. A pre-existing condition is any illness, injury, or medical condition you had before the effective date of your policy. This can include chronic conditions like diabetes, heart disease, asthma, or even a recent injury.

Why this exclusion exists: Insurance companies need to manage risk. Covering pre-existing conditions could potentially lead to higher claim payouts, as individuals with these conditions might be more likely to require medical attention while traveling.

Impact on your trip: If you have a pre-existing condition and don't have it covered by your policy, you could be responsible for all medical expenses related to that condition if it flares up during your trip. This could include doctor visits, hospital stays, medications, and even emergency medical evacuation, which can be incredibly expensive.

How to navigate this:

- Look for policies with pre-existing condition waivers: Some policies will waive the exclusion for pre-existing conditions if you purchase the policy within a certain timeframe after your initial trip deposit (usually within 14-21 days). You may also need to meet other requirements, such as being medically fit to travel at the time of purchase.

- Consider a specialized policy: If you have a significant pre-existing condition, it may be worth considering a specialized policy that is specifically designed to cover individuals with such conditions. These policies may be more expensive, but they will provide broader coverage and greater peace of mind.

- Disclose your conditions: Always be honest and disclose all pre-existing conditions when purchasing travel insurance. Failure to do so could invalidate your policy and result in denied claims.

Acts of War Terrorism and Travel Insurance Coverage

Travel insurance policies typically exclude coverage for events related to acts of war, terrorism, or civil unrest.

Why this exclusion exists: These events are considered catastrophic and unpredictable. The potential for widespread damage and injury makes them too risky for insurance companies to cover under standard policies.

Impact on your trip: If your trip is disrupted or you are injured due to an act of war or terrorism, your travel insurance policy likely won't cover your losses. This could include trip cancellation, trip interruption, medical expenses, and evacuation costs.

How to navigate this:

- Monitor travel advisories: Stay informed about the political and security situation at your destination by checking travel advisories issued by your government. Avoid traveling to areas that are considered high-risk.

- Consider "cancel for any reason" (CFAR) coverage: Some policies offer CFAR coverage as an add-on. This allows you to cancel your trip for any reason, including fear of terrorism or civil unrest, and receive a partial refund of your trip costs (usually 50-75%). CFAR coverage is typically more expensive than standard travel insurance.

- Look for policies with limited terrorism coverage: A few policies offer limited coverage for terrorist acts, but the coverage is often restricted to specific situations and capped at a certain amount.

Participation in Illegal Activities and Travel Insurance Policy Limitations

Travel insurance policies will not cover any losses or injuries that result from your participation in illegal activities.

Why this exclusion exists: Insurance companies are not going to endorse or provide coverage for illegal behavior.

Impact on your trip: If you are arrested or injured while engaging in illegal activities, such as drug use, theft, or other criminal offenses, your travel insurance policy will not cover your legal expenses, medical bills, or any other related costs. Your policy may also be canceled.

How to navigate this:

- Obey local laws: This should be obvious, but it's worth emphasizing. Familiarize yourself with the laws of the country you are visiting and avoid any activities that could get you into trouble.

Extreme Sports and Adventure Activities and Travel Insurance Coverage

Many travel insurance policies exclude or limit coverage for injuries sustained while participating in extreme sports or adventure activities. These can include activities like skydiving, bungee jumping, rock climbing, scuba diving, white-water rafting, and skiing (especially off-piste skiing).

Why this exclusion exists: These activities are inherently risky, and the potential for injury is higher than with more common travel activities.

Impact on your trip: If you are injured while participating in an excluded extreme sport or adventure activity, your travel insurance policy may not cover your medical expenses or evacuation costs.

How to navigate this:

- Purchase a policy that covers adventure activities: Look for policies that specifically cover the extreme sports or adventure activities you plan to participate in. These policies may be more expensive, but they will provide the necessary coverage.

- Check the policy's definition of "extreme sports": Some policies have very broad definitions of what constitutes an extreme sport, so be sure to read the policy wording carefully.

- Consider a specialized adventure travel policy: If you are planning a trip that is primarily focused on extreme sports or adventure activities, a specialized adventure travel policy may be the best option.

Pregnancy-Related Complications and Travel Insurance Coverage

Standard travel insurance policies typically exclude coverage for routine prenatal care or childbirth while traveling. They may also exclude coverage for pregnancy-related complications that occur within a certain timeframe before your due date.

Why this exclusion exists: Routine prenatal care and childbirth are generally considered planned medical events, not unforeseen emergencies. The risk of complications increases as a pregnancy progresses.

Impact on your trip: If you require routine prenatal care or go into labor while traveling, your travel insurance policy may not cover your medical expenses. If you experience pregnancy-related complications, your coverage may be limited or excluded depending on the policy's terms.

How to navigate this:

- Check the policy's pregnancy exclusion: Read the policy wording carefully to understand the specific limitations on pregnancy-related coverage.

- Consider a specialized maternity travel insurance policy: If you are pregnant and planning to travel, a specialized maternity travel insurance policy may provide broader coverage for pregnancy-related complications.

- Consult with your doctor: Before traveling while pregnant, consult with your doctor to ensure that it is safe for you to travel and to discuss any potential risks or complications.

Mental Health Conditions and Travel Insurance Policy Limitations

Coverage for mental health conditions can be tricky. Some policies may exclude or limit coverage for pre-existing mental health conditions, while others may offer limited coverage for new mental health issues that arise during your trip.

Why this exclusion exists: Similar to pre-existing physical conditions, mental health conditions can increase the risk of claims.

Impact on your trip: If you have a pre-existing mental health condition and it's not covered, you could face significant expenses if you need treatment while traveling. Even if the policy covers new mental health issues, there may be limitations on the number of therapy sessions or the types of treatment covered.

How to navigate this:

- Look for policies with mental health coverage: Carefully review the policy details to see if it covers mental health conditions. Pay attention to any limitations or exclusions.

- Talk to your insurance provider: If you have a pre-existing mental health condition, contact the insurance provider to discuss your specific needs and see if they can offer a rider or specialized coverage.

Alcohol and Drug Use and Travel Insurance Coverage

Travel insurance policies typically exclude coverage for incidents that occur while you are under the influence of alcohol or drugs. This includes injuries, illnesses, or accidents that are directly related to your intoxication.

Why this exclusion exists: Engaging in risky behavior while under the influence is considered a preventable risk, and insurance companies are unlikely to cover the consequences of such actions.

Impact on your trip: If you are injured in an accident while drunk, or if you become ill due to drug use, your travel insurance policy will likely not cover your medical expenses, trip cancellation, or any other related costs.

How to navigate this:

- Drink responsibly: If you choose to drink alcohol while traveling, do so in moderation.

- Avoid illegal drugs: Never use illegal drugs while traveling.

Unattended Belongings and Travel Insurance Coverage

Most travel insurance policies will not cover the theft or loss of unattended belongings. This means that if you leave your luggage unattended in a public place and it is stolen, your policy may not cover the loss.

Why this exclusion exists: Insurance companies expect you to take reasonable precautions to protect your belongings. Leaving them unattended is considered negligent.

Impact on your trip: If your unattended belongings are stolen or lost, you may not be able to recover their value through your travel insurance policy.

How to navigate this:

- Keep your belongings with you: Never leave your luggage or other valuables unattended in a public place.

- Use hotel safes: Store valuables in the hotel safe when you are not using them.

- Be aware of your surroundings: Be vigilant about your belongings and be aware of potential thieves.

Existing Travel Advisories and Travel Insurance Coverage

If your government has issued a travel advisory against traveling to a particular destination *before* you purchase your travel insurance policy, your policy may not cover losses related to that advisory. This often applies to advisories related to political unrest, natural disasters, or epidemics.

Why this exclusion exists: By issuing an advisory, the government is warning citizens of a known risk. Purchasing insurance after the risk is known is considered speculative.

Impact on your trip: If you purchase travel insurance after a travel advisory is issued and then cancel your trip due to the advisory, your policy may not reimburse you for your trip costs. If you travel to a destination against a travel advisory and experience problems, your coverage might also be limited.

How to navigate this:

- Purchase travel insurance early: Buy your travel insurance policy as soon as you book your trip. This way, you'll be covered for events that might occur before your departure.

- Monitor travel advisories: Stay informed about travel advisories issued by your government.

- Consider "cancel for any reason" (CFAR) coverage: CFAR coverage might allow you to cancel your trip even if there's a travel advisory, but it's important to check the specific terms and conditions.

Specific Travel Insurance Product Recommendations and Comparisons

Now that you know about common exclusions, let's look at some specific travel insurance products that offer different levels of coverage and address some of these exclusions.

World Nomads Explorer Plan: Adventure Travel Coverage

Description: World Nomads is a popular choice for adventure travelers. Their Explorer Plan offers coverage for a wide range of adventure activities, including many that are excluded from standard policies.

Key Features:

- Coverage for many adventure activities (check the specific activity list for details)

- Emergency medical coverage

- Trip interruption and cancellation coverage

- Baggage and personal effects coverage

Exclusions: Pre-existing conditions (unless specifically waived), participation in illegal activities, and certain high-risk activities (e.g., BASE jumping).

Use Case: Ideal for travelers planning to participate in activities like hiking, climbing, diving, and other adventure sports.

Pricing: Prices vary depending on the destination, trip length, and age of the traveler, but typically range from $80 to $200 for a two-week trip.

Allianz Global Assistance AllTrips Premier Plan: Annual Travel Insurance

Description: Allianz Global Assistance offers a variety of travel insurance plans, including annual plans that cover multiple trips within a year. The AllTrips Premier Plan provides comprehensive coverage for frequent travelers.

Key Features:

- Trip cancellation and interruption coverage

- Emergency medical and dental coverage

- Baggage loss and delay coverage

- Rental car collision damage waiver

Exclusions: Pre-existing conditions (unless specifically waived), acts of war, and participation in illegal activities.

Use Case: Best for travelers who take multiple trips per year and want a single policy to cover them all.

Pricing: Prices vary depending on the age of the traveler and the specific coverage limits, but typically range from $300 to $500 per year.

Travel Guard Travel Insurance: Comprehensive Coverage Options

Description: Travel Guard offers a range of travel insurance plans, including options for comprehensive coverage that include trip cancellation, medical expenses, and baggage protection. They also offer add-ons for specific needs.

Key Features:

- Trip cancellation and interruption

- Emergency medical and dental

- Baggage loss, delay, and damage

- 24/7 travel assistance

- Optional add-ons like "cancel for any reason" and adventure sports coverage.

Exclusions: Standard exclusions apply, such as pre-existing conditions (unless waived), acts of war, and participation in illegal activities. Read the policy wording carefully for a full list.

Use Case: Suitable for a wide range of travelers looking for a balance of coverage and price, with the option to customize the policy with add-ons to meet specific needs.

Pricing: Varies greatly based on the chosen plan, trip cost, destination, and traveler age. Get a quote online for your specific trip details.

MedjetAssist: Medical Transport and Evacuation Membership

Description: MedjetAssist is not traditional travel insurance, but rather a membership program that provides medical transport and evacuation services. If you become hospitalized while traveling, MedjetAssist will transport you to the hospital of your choice, regardless of medical necessity.

Key Features:

- Medical transport to the hospital of your choice

- No claim forms or deductibles

- Coverage for pre-existing conditions

Exclusions: Does not cover medical expenses or trip cancellation. It only covers medical transport.

Use Case: Ideal for travelers who are concerned about the possibility of needing medical transport and want the peace of mind of knowing they can be transported to the hospital of their choice.

Pricing: Annual memberships typically range from $300 to $500.

Comparison Table: Key Features and Exclusions

Here's a quick comparison table to help you see the key differences between these products:

| Product | Key Features | Notable Exclusions | Typical Use Case | Approximate Price (2-week trip) |

|---|---|---|---|---|

| World Nomads Explorer Plan | Adventure activities coverage, medical, trip interruption | Pre-existing conditions (unless waived), illegal activities | Adventure travelers | $80 - $200 |

| Allianz AllTrips Premier | Annual coverage, trip cancellation, medical, baggage | Pre-existing conditions (unless waived), acts of war | Frequent travelers | $300 - $500 (annual) |

| Travel Guard (Comprehensive Plans) | Customizable coverage, trip cancellation, medical, baggage | Pre-existing conditions (unless waived), acts of war, check policy for specifics | Travelers seeking a balance of price and coverage | Varies significantly, get a quote |

| MedjetAssist | Medical transport to hospital of choice, no claim forms | Does not cover medical expenses or trip cancellation | Travelers concerned about medical evacuation | $300 - $500 (annual) |

Tips for Choosing the Right Travel Insurance Policy

Choosing the right travel insurance policy can be overwhelming, but here are some tips to help you make an informed decision:

- Read the fine print: Don't just skim the policy summary. Read the entire policy document, including the exclusions section, to understand exactly what is and is not covered.

- Consider your destination and activities: Choose a policy that is appropriate for your destination and the activities you plan to participate in. If you are planning to engage in adventure sports, make sure your policy covers them.

- Compare policies: Don't just buy the first policy you see. Compare policies from different providers to find the best coverage and price.

- Pay attention to coverage limits: Make sure the policy's coverage limits are sufficient to cover your potential losses. For example, if you are traveling with expensive electronics, make sure the baggage coverage limit is high enough to cover their value.

- Consider add-ons: If you have specific needs, such as "cancel for any reason" coverage or coverage for pre-existing conditions, consider purchasing add-ons to your policy.

- Understand the claims process: Familiarize yourself with the claims process before you travel so you know what to do if you need to file a claim.

- Keep your policy information handy: Carry a copy of your travel insurance policy with you while you travel, along with the insurance company's contact information.

Understanding travel insurance exclusions is essential for protecting yourself from unexpected financial losses while traveling. By carefully reviewing policy exclusions, choosing the right policy for your needs, and taking precautions to minimize your risk, you can travel with greater peace of mind.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)