Life Insurance for Children: Is It a Good Idea?

Seniors often have unique travel insurance needs. Learn about travel insurance options specifically designed for seniors, considering factors like pre-existing conditions and medical coverage. Travel with peace of mind.

Understanding the Unique Travel Insurance Needs of Senior Citizens

Traveling is a fantastic way to experience the world, regardless of age. But for senior citizens, travel planning comes with its own set of unique considerations. From pre-existing medical conditions to potential mobility issues, it’s crucial to have the right travel insurance in place to ensure a safe and enjoyable trip. This article delves into the specific travel insurance needs of seniors, helping you navigate the options and choose the best policy for your individual circumstances.

Why Travel Insurance is Essential for Seniors: Pre-Existing Conditions and More

While travel insurance is recommended for everyone, it's particularly vital for seniors. Here's why:

- Pre-Existing Medical Conditions: Many seniors have pre-existing medical conditions like heart disease, diabetes, or arthritis. Standard travel insurance policies may not cover these conditions, or they may require a waiver. Finding a policy that adequately covers pre-existing conditions is paramount.

- Medical Emergencies: The risk of medical emergencies increases with age. Travel insurance can cover the costs of unexpected medical treatment, hospitalization, and even medical evacuation, which can be incredibly expensive, especially in foreign countries.

- Trip Cancellation and Interruption: Seniors may be more susceptible to unexpected events that could force them to cancel or interrupt their trip, such as illness or injury. Travel insurance can reimburse non-refundable trip expenses in these situations.

- Lost or Delayed Luggage: While not a life-or-death issue, lost or delayed luggage can be a significant inconvenience, especially for seniors who may rely on medication or assistive devices stored in their bags. Travel insurance can provide compensation for lost or delayed luggage.

- Mobility Issues: Seniors with mobility issues may require additional assistance during their travels, such as wheelchair rentals or special transportation. Some travel insurance policies can cover these expenses.

Key Features to Look for in Senior Travel Insurance: Finding the Right Coverage

When shopping for travel insurance for seniors, pay close attention to these key features:

- Comprehensive Medical Coverage: Ensure the policy provides adequate coverage for medical expenses, including hospitalization, doctor visits, and prescription medications. Check the policy limits and deductibles carefully.

- Pre-Existing Condition Coverage: Look for a policy that covers your pre-existing medical conditions, either automatically or with a waiver. Read the fine print to understand any limitations or exclusions.

- Emergency Medical Evacuation Coverage: This coverage is crucial in case you need to be transported to a hospital or medical facility in another country. Ensure the policy covers the full cost of medical evacuation, which can be very expensive.

- Trip Cancellation and Interruption Coverage: This coverage can reimburse non-refundable trip expenses if you need to cancel or interrupt your trip due to illness, injury, or other covered reasons.

- Baggage Loss and Delay Coverage: This coverage can provide compensation for lost or delayed luggage. Check the policy limits and deductibles.

- 24/7 Assistance: Look for a policy that offers 24/7 assistance in case you need help while traveling. This can be invaluable if you encounter a medical emergency or other unexpected situation.

- Coverage for Assistive Devices: If you rely on assistive devices like wheelchairs or walkers, ensure the policy covers loss, damage, or theft of these devices.

Travel Insurance Options for Seniors: Comparing Policies and Finding the Best Fit

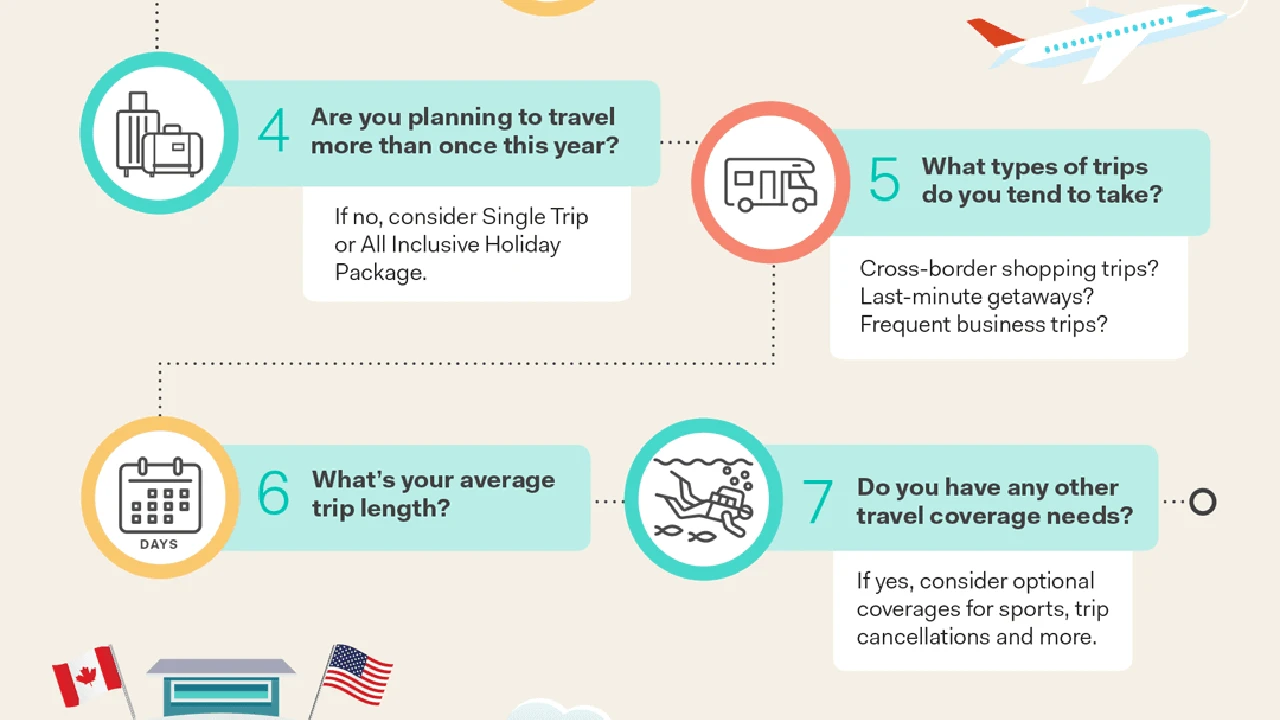

There are several different types of travel insurance policies available for seniors. Here's a breakdown of some of the most common options:

- Single-Trip Policies: These policies provide coverage for a single trip. They're a good option if you only travel occasionally.

- Multi-Trip Policies (Annual Policies): These policies provide coverage for multiple trips within a year. They can be a cost-effective option if you travel frequently.

- Comprehensive Policies: These policies offer the most comprehensive coverage, including medical expenses, trip cancellation and interruption, baggage loss and delay, and more.

- Medical-Only Policies: These policies focus primarily on medical coverage. They can be a good option if you're primarily concerned about medical emergencies.

- Cruise Insurance: This specialized type of travel insurance provides coverage for specific risks associated with cruises, such as trip interruptions and medical emergencies at sea.

Recommended Travel Insurance Companies for Seniors: Top Providers and Their Offerings

Choosing a reputable travel insurance company is just as important as choosing the right policy. Here are a few of the top travel insurance providers for seniors:

* **Allianz Travel Insurance:** Offers a variety of single-trip and multi-trip policies with comprehensive coverage options. They are known for their strong customer service and extensive network of medical providers. * **Allianz Prime Plan:** A popular choice for seniors, offering high medical coverage limits, pre-existing condition waivers (subject to eligibility), and trip cancellation/interruption benefits. Price varies based on age, trip length, and destination, but expect to pay around $150-$300 for a two-week trip for a 70-year-old. * **Travel Guard:** Provides a range of travel insurance policies with customizable options. They offer 24/7 assistance and a user-friendly claims process. * **Travel Guard Preferred Plan:** Provides coverage for pre-existing conditions if purchased within a specific timeframe of the initial trip deposit. It also includes coverage for trip delays, baggage loss, and medical expenses. Cost is typically in the range of $120-$250 for a two-week trip for a 70-year-old. * **World Nomads:** Primarily known for adventure travel insurance, but their policies can also be suitable for seniors who are active and adventurous. They offer coverage for a wide range of activities and destinations. * **World Nomads Explorer Plan:** Offers coverage for more adventurous activities and higher medical limits, making it suitable for active seniors. However, it's essential to carefully review the pre-existing condition clauses. Prices tend to be slightly higher, ranging from $200-$400 for a two-week trip for a 70-year-old, depending on the destination and activities. * **Seven Corners:** Specializes in travel insurance for international travelers, with policies that offer high medical coverage limits and 24/7 assistance. * **Seven Corners RoundTrip Choice Plan:** A comprehensive plan offering robust medical coverage, trip cancellation/interruption benefits, and coverage for pre-existing conditions (subject to certain conditions). Expect to pay approximately $180-$350 for a two-week trip for a 70-year-old. * **MedjetAssist:** While not strictly travel insurance, MedjetAssist provides medical transport membership. If you need to be hospitalized more than 150 miles from home, they will arrange and pay for medical transport to the hospital of your choice. This can be a valuable addition to a travel insurance policy. Membership prices vary depending on age and duration, but generally range from $295-$450 per year.Disclaimer: Prices are estimates and can vary depending on individual factors such as age, destination, trip length, and coverage options. Always obtain quotes from multiple providers and carefully review the policy terms and conditions before purchasing travel insurance.

Comparing Travel Insurance Products for Seniors: Choosing the Right Features and Benefits

Here's a more detailed comparison of the previously mentioned travel insurance plans, focusing on their strengths and weaknesses for senior travelers:

| Feature | Allianz Prime Plan | Travel Guard Preferred Plan | World Nomads Explorer Plan | Seven Corners RoundTrip Choice | MedjetAssist | | :-------------------------- | :------------------ | :--------------------------- | :-------------------------- | :----------------------------- | :-------------------------- | | Medical Coverage | High | Moderate | High | High | N/A (Medical Transport Only) | | Pre-Existing Conditions | Waiver (Eligibility) | Covered (Limited Time) | Review Clauses | Covered (Certain Conditions) | N/A | | Trip Cancellation/Interruption | Yes | Yes | Yes | Yes | N/A | | Baggage Loss/Delay | Yes | Yes | Yes | Yes | N/A | | Emergency Evacuation | Yes | Yes | Yes | Yes | Included in Membership | | 24/7 Assistance | Yes | Yes | Yes | Yes | Yes | | Adventure Activities | Limited | Limited | Yes | Limited | N/A | | Price (Estimated) | $150-$300 | $120-$250 | $200-$400 | $180-$350 | $295-$450/Year | | Best For | Comprehensive Coverage | Pre-Existing Condition Focus | Active Seniors | International Travel | Medical Transport Guarantee|When comparing plans, consider your individual needs and priorities. If you have significant pre-existing conditions, focus on policies that offer comprehensive coverage for those conditions. If you're planning adventurous activities, choose a policy that covers those activities. If you're primarily concerned about medical emergencies, consider a policy with high medical coverage limits. And if you want the peace of mind of guaranteed medical transport, MedjetAssist can be a valuable addition to your travel insurance plan.

Tips for Finding Affordable Senior Travel Insurance: Saving Money Without Sacrificing Coverage

Travel insurance can be a significant expense, but there are ways to save money without sacrificing coverage:

- Shop Around: Get quotes from multiple travel insurance companies and compare their policies and prices.

- Consider a Higher Deductible: Choosing a higher deductible can lower your premium.

- Buy Early: Purchasing your travel insurance policy early can allow you to take advantage of pre-existing condition waivers and trip cancellation benefits.

- Look for Discounts: Many travel insurance companies offer discounts for seniors, members of certain organizations, or those who purchase multiple policies.

- Consider a Multi-Trip Policy: If you travel frequently, a multi-trip policy can be more cost-effective than purchasing single-trip policies for each trip.

- Bundle with Other Travel Products: Some travel insurance companies offer discounts when you bundle your travel insurance with other travel products, such as flights or hotels.

- Review Your Existing Coverage: Check your existing health insurance policy and credit card benefits to see if they offer any travel coverage. This can help you avoid paying for duplicate coverage.

Navigating Pre-Existing Conditions: Understanding Coverage Options and Limitations

One of the biggest challenges for seniors seeking travel insurance is finding coverage for pre-existing medical conditions. Here's what you need to know:

- Disclosure is Key: Always disclose any pre-existing medical conditions to your travel insurance company. Failure to disclose can result in denied claims.

- Look for Waivers: Some travel insurance policies offer waivers that cover pre-existing conditions if you purchase the policy within a specific timeframe of your initial trip deposit.

- Understand the Stability Clause: Many policies require your pre-existing conditions to be stable for a certain period (e.g., 60-180 days) before your trip. This means that you haven't had any changes in medication, treatment, or hospitalization related to the condition.

- Consider Exclusion Riders: If you can't find a policy that covers all of your pre-existing conditions, you may be able to purchase an exclusion rider that excludes coverage for certain conditions while still covering other medical expenses.

- Be Prepared to Pay More: Coverage for pre-existing conditions often comes at a higher premium.

Making the Most of Your Travel Insurance Policy: Before, During, and After Your Trip

To ensure you're fully protected, here's how to make the most of your travel insurance policy before, during, and after your trip:

* Before Your Trip: * Read your policy carefully and understand the coverage limits, deductibles, and exclusions. * Keep a copy of your policy with you while traveling. * Provide your travel insurance company with your travel itinerary and contact information. * Contact your travel insurance company if you have any questions or concerns. * During Your Trip: * In case of a medical emergency, contact your travel insurance company's 24/7 assistance line immediately. * Keep all receipts for medical expenses, transportation, and other covered expenses. * Document any lost or delayed luggage with the airline or transportation provider. * Contact your travel insurance company if you need to cancel or interrupt your trip. * After Your Trip: * File a claim with your travel insurance company as soon as possible. * Provide all necessary documentation, including receipts, medical reports, and police reports. * Follow up with your travel insurance company if you haven't received a response within a reasonable timeframe.Addressing Common Concerns About Senior Travel Insurance: Providing Clear Answers

Here are answers to some common concerns about senior travel insurance:

* "Is travel insurance really necessary for seniors?" Yes, travel insurance is highly recommended for seniors due to the increased risk of medical emergencies, trip cancellations, and other unexpected events. * "Will my pre-existing conditions be covered?" It depends on the policy. Some policies offer coverage for pre-existing conditions, either automatically or with a waiver. Read the policy terms and conditions carefully. * "Is travel insurance expensive?" Travel insurance can be a significant expense, but there are ways to save money, such as shopping around, choosing a higher deductible, and looking for discounts. * "What if I don't need medical coverage?" Even if you have adequate health insurance, travel insurance can provide valuable coverage for trip cancellation, baggage loss, and other non-medical expenses. * "How do I file a claim?" The process for filing a claim varies depending on the travel insurance company. Contact your travel insurance company for instructions and required documentation.The Importance of Reading the Fine Print: Understanding Policy Terms and Conditions

Before purchasing any travel insurance policy, it's crucial to read the fine print and understand the policy terms and conditions. Pay close attention to the following:

- Coverage Limits: Understand the maximum amount the policy will pay for each type of covered expense.

- Deductibles: Know how much you'll have to pay out of pocket before the policy starts paying.

- Exclusions: Be aware of any events or situations that are not covered by the policy.

- Pre-Existing Condition Clauses: Understand the requirements for coverage of pre-existing medical conditions.

- Stability Clause: Know how long your pre-existing conditions must be stable before your trip.

- Claim Filing Procedures: Understand the process for filing a claim and the required documentation.

- Cancellation and Refund Policies: Know the policy's cancellation and refund policies.

Planning for a Safe and Enjoyable Trip: Peace of Mind with the Right Travel Insurance

Traveling as a senior citizen can be an incredibly rewarding experience. By understanding the unique travel insurance needs of seniors and taking the time to choose the right policy, you can travel with peace of mind, knowing that you're protected in case of unexpected events. Remember to shop around, compare policies, read the fine print, and choose a reputable travel insurance company. With the right travel insurance in place, you can focus on enjoying your trip and creating lasting memories.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

: Enrollment and Coverage.webp)