7 Best Homeowners Insurance Companies: Our Top Picks

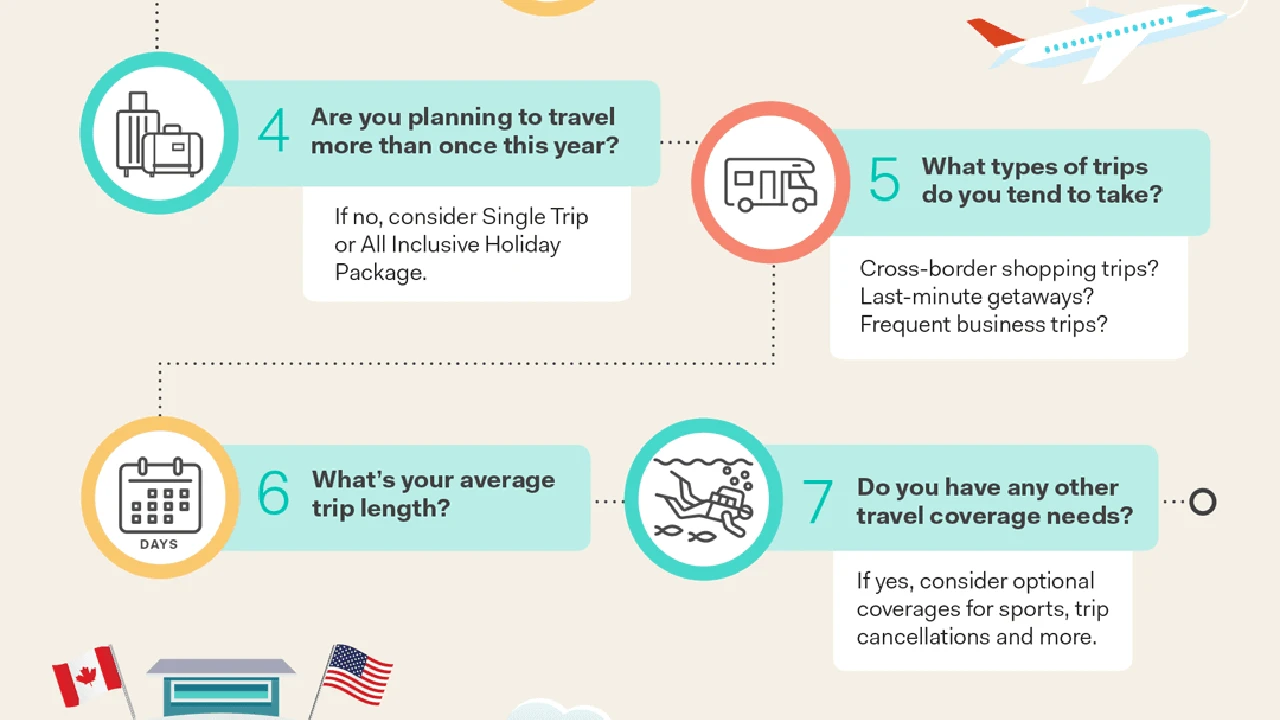

Traveling with pre-existing medical conditions requires careful planning Learn how travel insurance covers pre-existing conditions and what limitations may apply Ensure you have adequate coverage for your specific needs

Understanding Pre-Existing Conditions in Travel Insurance Policies

Okay, let's get straight to it Traveling with pre-existing conditions can be tricky when it comes to travel insurance. A pre-existing condition is any health issue you have *before* you buy your travel insurance policy. This includes everything from chronic illnesses like diabetes and asthma to heart conditions, high blood pressure, and even pregnancy. Basically, anything you've seen a doctor for or have been diagnosed with falls under this umbrella.

Why does this matter? Well, travel insurance companies need to assess the risk they're taking on when they insure you. If you have a pre-existing condition, the likelihood of you needing medical treatment while traveling might be higher, and that means the insurance company could potentially have to pay out a claim. Think of it like this: if you're already prone to back pain, the chances of you throwing your back out while lugging your suitcase around are probably greater than someone who's never had back issues.

Because of this increased risk, many standard travel insurance policies have exclusions or limitations regarding pre-existing conditions. An exclusion means the policy *won't* cover any medical expenses related to that specific condition. A limitation might mean they'll only cover certain aspects of it or have a waiting period before coverage kicks in.

It's super important to read the fine print of your policy and understand exactly what's covered and what's not. Don't just assume you're covered for everything! Failing to disclose a pre-existing condition can lead to your claim being denied, leaving you with potentially huge medical bills. No one wants that!

Types of Travel Insurance Coverage for Pre-Existing Conditions

Now for the good news! While standard policies might have limitations, there are definitely travel insurance options that can provide coverage for pre-existing conditions. Here are the main types you'll encounter:

- Waiver of Pre-Existing Condition Exclusion: Some policies offer a waiver that removes the pre-existing condition exclusion, providing you meet certain criteria. These criteria typically include:

- Purchasing the policy within a certain timeframe of your initial trip deposit (usually 14-21 days).

- Insuring the full non-refundable cost of your trip.

- Being medically fit to travel at the time of purchase.

- Policies with Limited Coverage: Other policies might offer limited coverage for pre-existing conditions. This could mean they'll cover emergencies related to your condition, but not routine care or ongoing treatment. Again, read the fine print carefully to understand the extent of the coverage.

- Specialized Travel Insurance Policies: Some insurance companies specialize in providing coverage for travelers with pre-existing medical conditions. These policies are often more expensive, but they can offer much broader coverage than standard policies.

- Travel Medical Insurance: This type of insurance primarily focuses on medical expenses incurred while traveling. It might offer some coverage for pre-existing conditions, but it's essential to check the details.

This is often the best option if you qualify, as it provides the most comprehensive coverage.

Factors Affecting Travel Insurance Premiums for Pre-Existing Conditions

Alright, let's talk money. It's no secret that travel insurance premiums for travelers with pre-existing conditions are often higher than for those without. Several factors influence the price you'll pay:

- Severity of the Condition: The more serious your condition, the higher the risk for the insurance company, and the higher your premium will be.

- Age: Older travelers generally pay more for travel insurance, and this is even more true if they have pre-existing conditions.

- Destination: Medical costs vary significantly from country to country. If you're traveling to a country with high medical expenses, your premium will likely be higher.

- Trip Length: The longer your trip, the greater the risk of a medical issue arising, and the higher your premium will be.

- Coverage Level: The more comprehensive the coverage you choose, the higher your premium will be.

- Deductible: Choosing a higher deductible (the amount you pay out-of-pocket before the insurance kicks in) can lower your premium.

It's a good idea to get quotes from multiple insurance companies to compare prices and coverage options. Don't just go with the first quote you receive!

Tips for Finding the Best Travel Insurance with Pre-Existing Condition Coverage

Finding the right travel insurance when you have pre-existing conditions can feel overwhelming, but here are some tips to help you navigate the process:

- Be Honest and Disclose Everything: Don't try to hide your medical history. Honesty is crucial! Failing to disclose a pre-existing condition can invalidate your policy and leave you with uncovered medical bills.

- Shop Around and Compare Quotes: Get quotes from multiple insurance companies, including those that specialize in covering pre-existing conditions. Use online comparison tools to make the process easier.

- Read the Fine Print Carefully: Don't just skim the policy document. Pay close attention to the exclusions, limitations, and terms and conditions.

- Understand the Definition of "Stable": Many policies require your pre-existing condition to be "stable" for a certain period (e.g., 60-180 days) before your trip. This means there haven't been any changes in your medication, treatment, or symptoms. Make sure you meet this requirement.

- Consider a Policy with a Waiver: If you qualify for a waiver of the pre-existing condition exclusion, it's usually the best option for comprehensive coverage.

- Talk to a Travel Insurance Agent: A knowledgeable travel insurance agent can help you understand your options and find the best policy for your specific needs.

- Keep Medical Records Handy: Bring copies of your medical records, prescriptions, and doctor's contact information with you on your trip. This can be helpful if you need medical treatment.

- Understand Emergency Assistance Services: Make sure your policy includes 24/7 emergency assistance services. This can be invaluable if you need help arranging medical care or transportation.

Specific Travel Insurance Products Recommended for Pre-Existing Conditions

Alright, let's get down to some specific product recommendations. Keep in mind that these are just examples, and the best policy for you will depend on your individual circumstances. *Always get a personalized quote based on your medical history and travel plans.*

- World Nomads Explorer Plan (with optional add-ons): World Nomads is a popular choice for adventurous travelers, and their Explorer Plan offers some coverage for pre-existing conditions, particularly if you purchase the policy within a certain timeframe of your initial trip deposit and meet their stability requirements. They also offer add-ons for specific activities.

- Scenario: A 50-year-old with well-managed type 2 diabetes is planning a hiking trip in the Swiss Alps. The Explorer Plan, purchased within 14 days of the trip deposit, provides coverage for emergencies related to their diabetes.

- Pros: Good for adventure activities, flexible coverage options, 24/7 emergency assistance.

- Cons: May not offer the most comprehensive coverage for all pre-existing conditions.

- Estimated Price: Varies depending on trip length and coverage options, but expect to pay around $100-$200 for a 7-day trip.

- Allianz Global Assistance (various plans): Allianz offers a range of travel insurance plans, some of which include coverage for pre-existing conditions if certain requirements are met, such as purchasing the policy within a specific timeframe and meeting the stability clause. They have plans designed for different types of travelers, from leisure travelers to business travelers.

- Scenario: A 65-year-old with a history of heart disease is taking a cruise in the Caribbean. Allianz's Prime Plan, purchased within 21 days of the trip deposit, provides coverage for emergencies related to their heart condition, assuming they meet the stability requirements.

- Pros: Wide range of plans to choose from, good customer service reputation, coverage for trip cancellation and interruption.

- Cons: Pre-existing condition coverage can be limited depending on the plan.

- Estimated Price: Varies widely depending on the plan and coverage options, but expect to pay around $150-$300 for a 7-day cruise.

- Travel Guard (various plans): Travel Guard is another reputable travel insurance provider with a variety of plans, some offering waivers for pre-existing condition exclusions if purchased within a specific timeframe.

- Scenario: A 40-year-old with well-controlled asthma is planning a trip to Europe. Travel Guard's Gold Plan, purchased within 15 days of the trip deposit, offers a waiver of the pre-existing condition exclusion, providing coverage for emergencies related to their asthma.

- Pros: Good coverage for trip delays and baggage loss, 24/7 travel assistance services.

- Cons: Can be more expensive than some other options.

- Estimated Price: Varies depending on the plan and coverage options, but expect to pay around $180-$350 for a 10-day trip.

- InsureMyTrip (Comparison Tool): This isn't an insurance company itself, but rather a website that allows you to compare quotes from multiple insurance providers. It's a great way to shop around and find the best deal. You can filter your search based on your pre-existing conditions and other requirements.

- Scenario: You have multiple pre-existing conditions and want to see all the available policies and their prices in one place.

- Pros: Saves time and effort, allows you to compare multiple quotes side-by-side.

- Cons: You still need to read the fine print of each policy carefully.

- Estimated Price: Free to use the comparison tool.

Important Considerations When Comparing Products:

- Stability Clause: Pay close attention to the stability period required by each policy. This is the period of time your pre-existing condition needs to be stable before your trip.

- Medical Coverage Limits: Make sure the policy provides adequate medical coverage limits, especially if you're traveling to a country with high medical costs.

- Emergency Assistance Services: Ensure the policy includes 24/7 emergency assistance services.

- Exclusions: Carefully review the exclusions to understand what's *not* covered.

- Read Reviews: Check online reviews to see what other travelers have to say about their experience with the insurance company.

Comparing Travel Insurance Options: Real-World Examples

Let's look at some head-to-head comparisons to illustrate the differences between policies. Remember, these are simplified examples, and you should always get a personalized quote.

Example 1: Diabetes Coverage

- Traveler: A 55-year-old with well-managed type 1 diabetes traveling to Mexico for a week.

- Policy A (Standard Policy): Excludes coverage for pre-existing conditions. If the traveler requires insulin or medical attention related to their diabetes, they'll have to pay out of pocket. Price: $80.

- Policy B (Policy with Waiver): Waives the pre-existing condition exclusion, providing coverage for emergencies related to diabetes. Price: $180.

- Analysis: While Policy B is more expensive, it provides significantly better protection for the traveler. The cost of a single medical visit in Mexico could easily exceed the difference in price between the two policies.

Example 2: Heart Condition Coverage

- Traveler: A 70-year-old with a history of heart disease traveling to Italy for two weeks.

- Policy A (Limited Coverage): Provides coverage for emergencies related to heart disease, but not for routine care or ongoing treatment. Price: $200.

- Policy B (Specialized Policy): Offers more comprehensive coverage for heart disease, including coverage for routine care and ongoing treatment (subject to certain limitations). Price: $400.

- Analysis: Policy B is a better choice for the traveler if they anticipate needing routine care or have concerns about their heart condition flaring up during the trip.

Alternative Options to Travel Insurance for Pre-Existing Conditions

While travel insurance is generally the best option for protecting yourself financially while traveling with pre-existing conditions, there are a few alternative options to consider:

- Travel within Your Health Insurance Network: If possible, choose a destination where your existing health insurance provides coverage. This can significantly reduce your out-of-pocket expenses. However, make sure you understand the limitations of your coverage, such as whether you'll need to pay upfront and seek reimbursement later.

- Consider a Medical Tourism Destination: If you need medical treatment, consider traveling to a medical tourism destination where healthcare costs are lower. However, research the quality of care carefully before making a decision. This isn't a replacement for travel insurance, but a way to potentially reduce medical expenses.

- Self-Insurance: Set aside a significant amount of money to cover potential medical expenses. This is a risky option, as medical emergencies can be very expensive. This is only advisable if you have substantial savings and are comfortable taking on the financial risk.

These alternatives are generally not as comprehensive as travel insurance and should only be considered after carefully weighing the risks and benefits.

Final Thoughts: Prioritize Your Health and Safety While Traveling

Traveling with pre-existing conditions requires careful planning and preparation. By understanding your options, comparing policies, and being honest about your medical history, you can find the right travel insurance to protect yourself financially and enjoy a safe and worry-free trip. Don't skimp on coverage – the peace of mind is worth it!

Remember to always consult with your doctor before traveling to discuss any potential health risks and get their recommendations for managing your pre-existing conditions while you're away. Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)