Homeowners Insurance Claims: A Step-by-Step Guide

Homeowners insurance protects your home and belongings from various perils. This comprehensive guide explains the basics of homeowners insurance, including coverage types, policy limits, and deductibles. Understand your policy and protect your investment.

Understanding the Basics of Homeowners Insurance Claims

Okay, so something happened. A tree fell on your roof, a pipe burst, or maybe you had a break-in. Whatever it is, you need to file a homeowners insurance claim. Don’t panic! It can seem overwhelming, but breaking it down into steps makes it manageable. Think of this as your friendly guide through the insurance maze.

The first thing you need to do is **assess the damage**. Take photos or videos of everything. This is crucial! Your insurance company will want to see the extent of the damage before they send someone out to inspect it. Don't touch anything unless it poses an immediate safety hazard. For example, if there's water damage, turn off the electricity to that area to avoid electrocution.

Next, **contact your insurance company ASAP**. Most policies have a timeframe for reporting claims, and the sooner you report, the better. Have your policy number handy. When you call, be prepared to describe what happened, when it happened, and the extent of the damage. They'll give you a claim number, which you'll need for all future communication.

Step 1 Immediate Actions After Damage Home Safety and Documentation

Before you even think about the insurance company, ensure your safety. Is the structure stable? Are there exposed wires or gas leaks? If so, call the appropriate emergency services immediately. Once the immediate danger is addressed, start documenting *everything*. Photos, videos, notes – the more, the merrier. This documentation will be invaluable when you file your claim and negotiate with the insurance adjuster.

Securing your property is also vital. Board up broken windows, cover damaged roofs with tarps (if safe to do so), and prevent further damage. Keep receipts for any emergency repairs you make, as your insurance policy might cover these costs. Remember, you have a responsibility to mitigate further damage.

Step 2 Contacting Your Insurance Company Reporting the Claim Effectively

Now it's time to contact your insurance company. Have your policy number and documentation readily available. Be prepared to answer questions about the incident, including the date, time, cause, and extent of the damage. Be honest and concise, sticking to the facts. Don’t speculate or exaggerate the damage.

Ask about your deductible – the amount you'll have to pay out of pocket before your insurance coverage kicks in. Also, inquire about the claims process, the timeline for inspection, and the contact information for your assigned adjuster. Take notes of your conversations, including the date, time, and the representative's name.

Step 3 The Insurance Adjuster Inspection What to Expect

The insurance adjuster is your key contact throughout the claims process. They will inspect the damage, assess the value of your loss, and determine the amount your insurance company will pay. Before the adjuster arrives, review your documentation and prepare a list of questions. Point out all the damage you've identified, even seemingly minor issues.

Don't be afraid to ask the adjuster to explain their assessment. If you disagree with their findings, politely express your concerns and provide additional evidence to support your claim. Remember, negotiation is often part of the process. If you're not comfortable negotiating on your own, consider hiring a public adjuster to represent your interests.

Step 4 Documenting Everything and Keeping Records Organized

We can't stress this enough: document everything! Keep copies of all communication with your insurance company, including emails, letters, and phone call logs. Organize your photos, videos, receipts, and other documentation in a binder or digital folder. This comprehensive record will be invaluable if disputes arise or if you need to appeal the insurance company's decision.

Consider using a spreadsheet to track your expenses related to the claim, including repair costs, temporary housing expenses, and the value of damaged personal property. The more organized you are, the smoother the claims process will be.

Step 5 Understanding Your Homeowners Insurance Policy Coverage Details

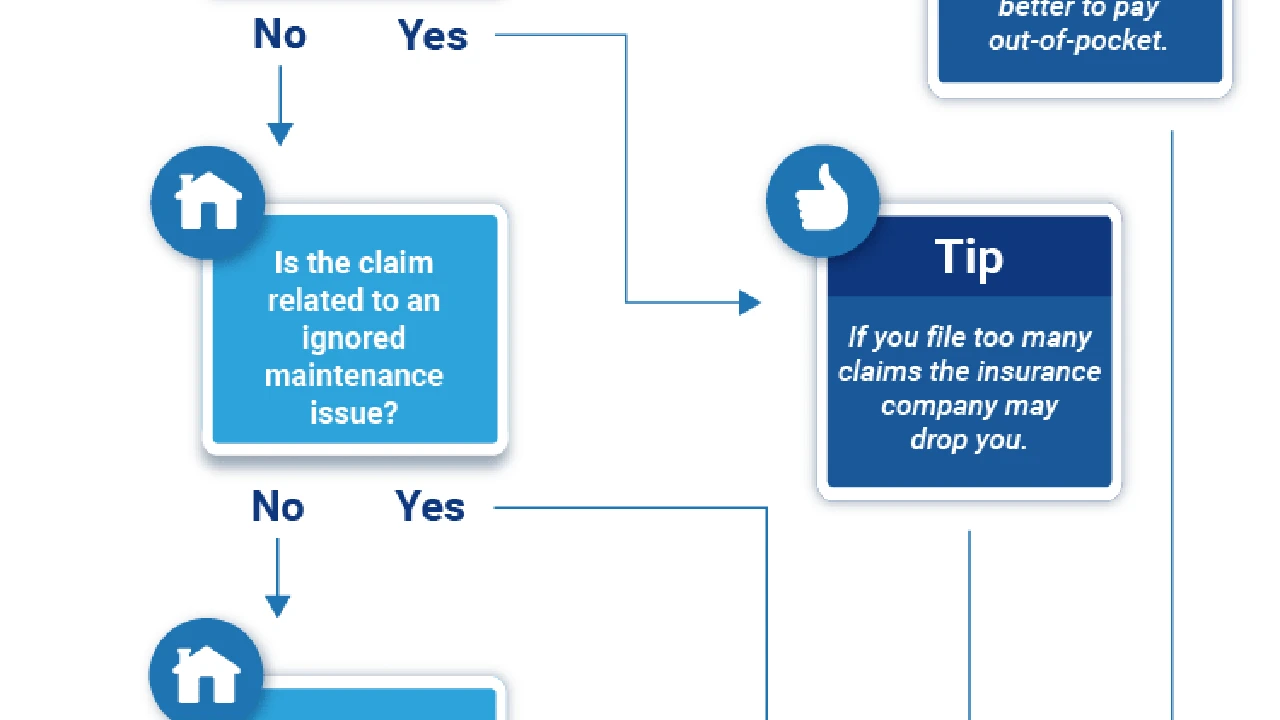

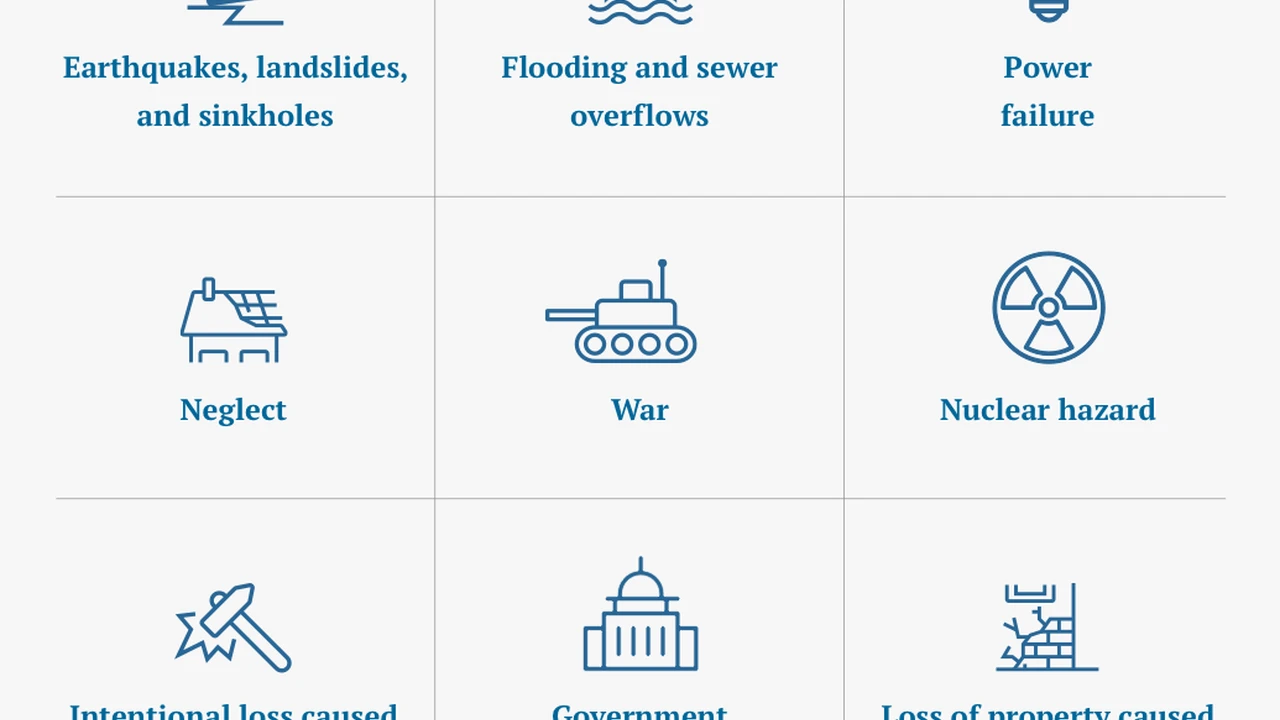

Your homeowners insurance policy is a complex document, but it's essential to understand its coverage details. Review your policy to determine what perils are covered, what exclusions apply, and what your policy limits are. Pay attention to the difference between replacement cost coverage and actual cash value coverage. Replacement cost coverage will pay to replace damaged items with new ones, while actual cash value coverage will only pay the depreciated value of the items.

If you have questions about your policy, don't hesitate to contact your insurance agent or company representative. They can help you understand the fine print and ensure you have adequate coverage for your needs.

Step 6 Getting Estimates for Repairs Finding Reputable Contractors

Before you start repairs, get estimates from multiple contractors. Contact at least three licensed and insured contractors to provide written bids for the work. Compare the estimates carefully, paying attention to the scope of work, materials used, and the contractor's reputation. Check online reviews and ask for references from previous clients.

Be wary of contractors who pressure you to sign a contract immediately or who offer unusually low bids. These could be signs of a scam. Always get a written contract that outlines the scope of work, payment terms, and warranty information before you start any repairs.

Step 7 Negotiating with the Insurance Company Getting a Fair Settlement

Once you've received the insurance adjuster's assessment and the contractors' estimates, it's time to negotiate a settlement with the insurance company. If the adjuster's assessment is lower than the contractors' estimates, provide additional documentation to support your claim. This could include photos, videos, receipts, and expert opinions.

Be prepared to negotiate and compromise. The insurance company may not agree to pay for everything you're claiming, but you should strive to reach a fair settlement that covers your losses. If you're not comfortable negotiating on your own, consider hiring a public adjuster to represent your interests. They are experts in negotiating with insurance companies and can help you get a better settlement.

Step 8 Specific Product Recommendations for Home Repair and Protection After a Claim

After a homeowners insurance claim, you'll likely need to repair or replace damaged items and take steps to protect your home from future incidents. Here are a few specific product recommendations that can help:

Water Leak Detectors and Smart Home Water Damage Prevention

Water damage is a common and costly homeowners insurance claim. Investing in water leak detectors can help prevent significant damage by alerting you to leaks before they cause major problems.

- Flo by Moen Smart Water Shutoff: This device monitors your home's water usage and can detect leaks as small as a drop per minute. It can automatically shut off the water supply to prevent further damage. It costs around $500. Its best used in scenarios where there is a history of pipe leakage.

- StreamLabs Smart Home Water Monitor: Similar to Flo by Moen, StreamLabs monitors water usage and detects leaks. It also provides insights into your water consumption habits. At approximately $200. This is suitable for homes where the risk of leakage is not high, but the user wants to monitor usage of water.

- Usage Scenario: Install these devices near water sources like washing machines, dishwashers, and water heaters. The sensors will notify you via smartphone if a leak is detected, allowing you to take immediate action.

Security Systems and Home Security Protection

Burglary and theft are also common homeowners insurance claims. A security system can deter criminals and provide evidence in case of a break-in.

- Ring Alarm Security Kit: This DIY security system includes a base station, keypad, contact sensors for doors and windows, and a motion detector. It can be monitored professionally or self-monitored. The basic kit starts at around $200. Its best used for renters who want to take the security system with them when they leave.

- ADT Home Security: ADT offers professional installation and monitoring services. Their systems include a range of features, such as intrusion detection, fire detection, and 24/7 monitoring. Pricing varies depending on the system and monitoring plan. This is best used for homeowners who plan to stay in their homes for a long time.

- Usage Scenario: Install contact sensors on all exterior doors and windows. Place motion detectors in high-traffic areas and consider adding security cameras for outdoor surveillance.

Smart Thermostats Energy Efficiency and Savings

Smart thermostats can help you save money on your energy bills and reduce the risk of HVAC system failures, which can lead to homeowners insurance claims.

- Nest Learning Thermostat: This thermostat learns your heating and cooling preferences and adjusts the temperature automatically to save energy. It can also be controlled remotely via smartphone. It costs around $250. This is best used for families who want to save on their energy bills.

- Ecobee Smart Thermostat with Voice Control: Similar to Nest, Ecobee learns your preferences and adjusts the temperature automatically. It also includes built-in voice control with Amazon Alexa. Costs around $200. This is best used for families who use Alexa as their smart home device.

- Usage Scenario: Install the thermostat in a central location in your home. Program it to adjust the temperature when you're away or asleep to save energy.

Smoke and Carbon Monoxide Detectors Early Warning Systems

Smoke and carbon monoxide detectors are essential for protecting your family from fire and carbon monoxide poisoning. Make sure you have working detectors on every level of your home and test them regularly.

- Nest Protect Smoke and Carbon Monoxide Detector: This detector not only detects smoke and carbon monoxide but also provides voice alerts and sends notifications to your smartphone. It costs around $120. Its best used for homes where there are young children or elderly people.

- First Alert Combination Smoke and Carbon Monoxide Detector: This detector combines smoke and carbon monoxide detection in one device. It features a loud alarm and a long-lasting battery. Costs around $30. This is best used for homes where there is a history of fire or carbon monoxide poisoning.

- Usage Scenario: Install detectors on every level of your home, especially near bedrooms and sleeping areas. Test them monthly and replace the batteries annually.

Step 9 Filing the Claim and Following Up

Once you've gathered all the necessary documentation and negotiated a settlement with the insurance company, it's time to file your claim. Fill out the claim form accurately and completely, and attach all supporting documentation. Submit the claim form to your insurance company and keep a copy for your records.

Follow up with your insurance company regularly to check on the status of your claim. If you haven't heard back from them within a reasonable timeframe, contact your adjuster or the claims department to inquire about the progress. Be persistent and advocate for yourself to ensure your claim is processed fairly and efficiently.

Step 10 Appealing a Denial or Disagreement

If your homeowners insurance claim is denied or if you disagree with the settlement offer, you have the right to appeal the decision. Review your policy carefully to understand your rights and the appeals process. Gather additional evidence to support your claim, such as expert opinions or additional contractors' estimates.

Submit your appeal in writing to your insurance company, clearly outlining the reasons why you believe the denial or settlement offer is unfair. Be prepared to negotiate and compromise, but don't be afraid to fight for the coverage you deserve. If you're not successful in appealing the decision directly with the insurance company, you may have the option to file a complaint with your state's insurance department or pursue legal action.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

: Enrollment and Coverage.webp)