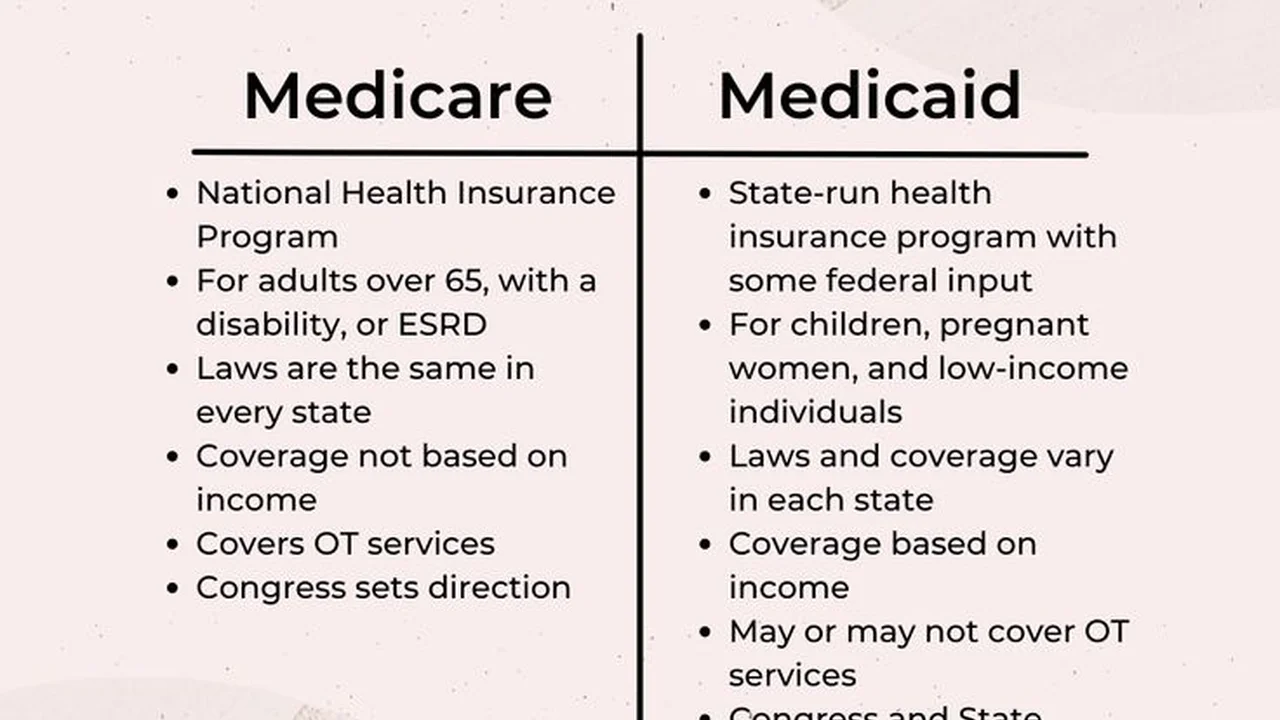

Medicare vs. Medicaid: What's the Difference?

Travel Insurance for Seniors Specific Considerations Seniors often have unique travel insurance needs Learn about travel insurance options specifically designed for seniors considering factors like pre-existing conditions and medical coverage Travel with peace of mind

Understanding Travel Insurance Needs for Seniors Pre-Existing Conditions Coverage

Traveling as a senior often comes with unique considerations, particularly regarding health. One of the biggest concerns is pre-existing medical conditions. Many standard travel insurance policies have limitations or exclusions related to these conditions, so it’s crucial to find a policy that offers adequate coverage. This means carefully reviewing the policy wording to understand what is and isn’t covered. Some policies may require a medical assessment or charge a higher premium for covering pre-existing conditions.

For example, let's say you have diabetes or heart disease. A standard policy might only cover emergency treatment related to these conditions, or it might exclude them altogether. A specialized senior travel insurance policy, on the other hand, might offer more comprehensive coverage, including routine care and medication refills. It's worth spending the time to research and compare policies to ensure you have the right level of protection.

Medical Coverage and Emergency Assistance for Senior Travelers

Comprehensive medical coverage is paramount for senior travel insurance. This should include not only emergency medical expenses but also coverage for hospitalization, surgery, and repatriation (the cost of returning home for medical treatment). Emergency assistance services are also vital, providing 24/7 support for medical emergencies, lost luggage, and other travel-related issues.

Imagine you're on a trip to Europe and you experience a sudden health issue requiring hospitalization. Without adequate medical coverage, you could face enormous medical bills. A good travel insurance policy will cover these expenses, as well as the cost of an emergency medical evacuation if necessary. Emergency assistance services can also help you find a local doctor or hospital, translate medical documents, and coordinate with your family back home.

Trip Cancellation and Interruption Insurance for Senior Citizens

Life can be unpredictable, and seniors are often more vulnerable to unexpected events that can disrupt travel plans. Trip cancellation and interruption insurance can provide reimbursement for non-refundable trip expenses if you have to cancel or cut short your trip due to illness, injury, or other covered reasons.

For instance, if you have to cancel your trip because you or a family member becomes ill, trip cancellation insurance can reimburse you for the cost of your flights, hotel reservations, and other pre-paid expenses. Trip interruption insurance can cover similar expenses if you have to return home unexpectedly during your trip. Carefully review the policy wording to understand the covered reasons for cancellation and interruption.

Baggage Loss and Delay Insurance for Senior Travelers

Losing luggage can be a major inconvenience, especially for seniors who may rely on specific medications or medical equipment. Baggage loss and delay insurance can provide reimbursement for lost or delayed luggage, as well as essential items you need to purchase while your luggage is delayed.

If your luggage is lost or delayed, baggage insurance can reimburse you for the cost of replacing your clothing, toiletries, and other essential items. Some policies also provide coverage for the cost of medication refills if your medication is lost with your luggage. Be sure to keep receipts for any purchases you make, as you'll need them to file a claim.

Specific Policy Features to Look for in Senior Travel Insurance

When shopping for senior travel insurance, there are several specific policy features to look for to ensure you have adequate coverage:

- Pre-existing condition coverage: As mentioned earlier, this is crucial for seniors with pre-existing medical conditions.

- High medical coverage limits: Make sure the policy provides high enough medical coverage limits to cover potential medical expenses in your destination.

- 24/7 emergency assistance: Look for a policy with 24/7 emergency assistance services to provide support in case of medical emergencies, lost luggage, or other travel-related issues.

- Trip cancellation and interruption coverage: This can protect you from financial loss if you have to cancel or cut short your trip due to unexpected events.

- Baggage loss and delay coverage: This can reimburse you for lost or delayed luggage, as well as essential items you need to purchase while your luggage is delayed.

- Worldwide coverage: Ensure the policy provides coverage in all of the destinations you plan to visit.

- Age limits: Some policies have age limits, so make sure the policy is available to seniors of your age.

Recommended Travel Insurance Products for Seniors: A Comparison

Here are a few recommended travel insurance products for seniors, along with a comparison of their key features and prices. Keep in mind that prices can vary depending on your age, destination, trip duration, and coverage options, so it's always best to get a personalized quote from each provider.

1. Allianz Travel Insurance Senior Plans

Overview: Allianz offers a range of travel insurance plans designed specifically for seniors, with comprehensive coverage for pre-existing conditions, medical expenses, and trip cancellation. They also offer 24/7 emergency assistance services.

Key Features:

- Coverage for pre-existing conditions (subject to certain conditions)

- High medical coverage limits (up to $500,000)

- 24/7 emergency assistance services

- Trip cancellation and interruption coverage

- Baggage loss and delay coverage

Typical Price: $150 - $300 for a 2-week trip, depending on age and coverage options.

Pros: Comprehensive coverage, reputable provider, excellent customer service.

Cons: Can be more expensive than other options, pre-existing condition coverage may have limitations.

Ideal for: Seniors who want comprehensive coverage and peace of mind, especially those with pre-existing medical conditions.

2. Travel Guard Travel Insurance Senior Plans

Overview: Travel Guard offers a variety of travel insurance plans for seniors, with customizable coverage options to meet individual needs. They also offer 24/7 emergency assistance services and trip cancellation coverage.

Key Features:

- Customizable coverage options

- 24/7 emergency assistance services

- Trip cancellation and interruption coverage

- Baggage loss and delay coverage

- Optional coverage for pre-existing conditions (subject to certain conditions)

Typical Price: $100 - $250 for a 2-week trip, depending on age and coverage options.

Pros: Customizable coverage, competitive pricing, good customer service.

Cons: Pre-existing condition coverage may be limited, coverage options can be confusing.

Ideal for: Seniors who want customizable coverage options and competitive pricing.

3. World Nomads Travel Insurance Explorer Plan (for Active Seniors)

Overview: While not specifically designed for seniors, World Nomads' Explorer Plan offers comprehensive coverage for adventurous travelers, including coverage for medical expenses, trip cancellation, and baggage loss. It's a good option for active seniors who plan to participate in outdoor activities.

Key Features:

- Coverage for a wide range of activities

- High medical coverage limits (up to $1 million)

- 24/7 emergency assistance services

- Trip cancellation and interruption coverage

- Baggage loss and delay coverage

Typical Price: $120 - $280 for a 2-week trip, depending on age and coverage options.

Pros: Comprehensive coverage for adventurous travelers, good customer service, easy to purchase online.

Cons: May not be the best option for seniors with significant pre-existing medical conditions, can be more expensive than other options.

Ideal for: Active seniors who plan to participate in outdoor activities and want comprehensive coverage.

4. MedjetAssist (Medical Evacuation Membership)

Overview: MedjetAssist is not technically travel insurance, but a medical evacuation membership program. It arranges and pays for medical transport to the hospital of your choice in your home country if you become critically ill or injured while traveling. This can be a valuable addition to travel insurance, especially for seniors who want to ensure they can receive treatment at their preferred hospital.

Key Features:

- Medical transport to the hospital of your choice

- No claim forms or deductibles

- 24/7 emergency assistance services

- Coverage for pre-existing conditions

Typical Price: $295 - $495 for an annual membership, depending on age and coverage options.

Pros: Ensures medical transport to your preferred hospital, no claim forms or deductibles, coverage for pre-existing conditions.

Cons: Does not cover medical expenses, only covers medical transport.

Ideal for: Seniors who want to ensure they can receive treatment at their preferred hospital in case of a medical emergency.

The Importance of Reading the Fine Print in Senior Travel Insurance Policies

It's absolutely critical to read the fine print of any travel insurance policy before you purchase it, especially as a senior. Pay close attention to the following:

- Exclusions: Understand what is not covered by the policy. Common exclusions include pre-existing conditions, acts of war, and participation in illegal activities.

- Limitations: Understand the limits of coverage for specific benefits, such as medical expenses, trip cancellation, and baggage loss.

- Waiting periods: Some policies have waiting periods before certain benefits become effective.

- Claim filing procedures: Know how to file a claim and what documentation you'll need to provide.

- Pre-existing condition requirements: Understand the requirements for covering pre-existing conditions, such as medical assessments and premium surcharges.

If you have any questions or concerns about the policy wording, don't hesitate to contact the insurance provider for clarification. It's better to be fully informed before you purchase the policy than to discover a coverage gap after you've already had an incident.

Tips for Saving Money on Travel Insurance for Seniors

Here are a few tips for saving money on travel insurance for seniors:

- Shop around and compare quotes: Get quotes from multiple insurance providers and compare their coverage options and prices.

- Consider a higher deductible: Choosing a higher deductible can lower your premium, but make sure you can afford to pay the deductible if you need to file a claim.

- Purchase a multi-trip policy: If you plan to take multiple trips within a year, a multi-trip policy can be more cost-effective than purchasing individual policies for each trip.

- Look for discounts: Some insurance providers offer discounts for seniors, members of certain organizations, or those who purchase their policy online.

- Consider a medical evacuation membership: If you're primarily concerned about medical evacuation, a membership program like MedjetAssist can be a more affordable option than purchasing comprehensive travel insurance.

Planning Your Trip with Your Travel Insurance Needs in Mind

When planning your trip, consider your travel insurance needs. For example:

- Choose destinations with good medical facilities: If you have pre-existing medical conditions, consider choosing destinations with reputable medical facilities.

- Avoid risky activities: If you're concerned about medical expenses, avoid participating in risky activities that could increase your risk of injury.

- Pack essential medications: Make sure to pack enough of your essential medications to last for the duration of your trip.

- Keep your insurance information handy: Keep a copy of your travel insurance policy and emergency contact information with you at all times.

By planning your trip with your travel insurance needs in mind, you can minimize your risk of unexpected expenses and ensure you have a safe and enjoyable travel experience.

Conclusion: Travel Insurance for Seniors Ensuring Peace of Mind

Choosing the right travel insurance for seniors is an important step in ensuring peace of mind while traveling. By carefully considering your individual needs and comparing different policy options, you can find a policy that provides adequate coverage and protects you from unexpected expenses. Remember to read the fine print, shop around for the best prices, and plan your trip with your travel insurance needs in mind. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)