Life Insurance Payout: What to Expect

Life insurance payout Understanding the life insurance payout process is important for beneficiaries Learn what to expect after filing a claim including required documentation and payment options Ensure a smooth and efficient payout process

Understanding the Basics of Life Insurance Payouts

Okay, so someone you care about had a life insurance policy and now you're the beneficiary. First off, I'm sorry for your loss. Dealing with life insurance claims can feel overwhelming when you're already grieving. Let's break down what you can expect so you're not caught off guard.

A life insurance payout, simply put, is the money the insurance company pays to the beneficiary (that's you!) after the insured person passes away. It's designed to help you manage financially, cover funeral costs, pay off debts, or just provide some stability during a tough time.

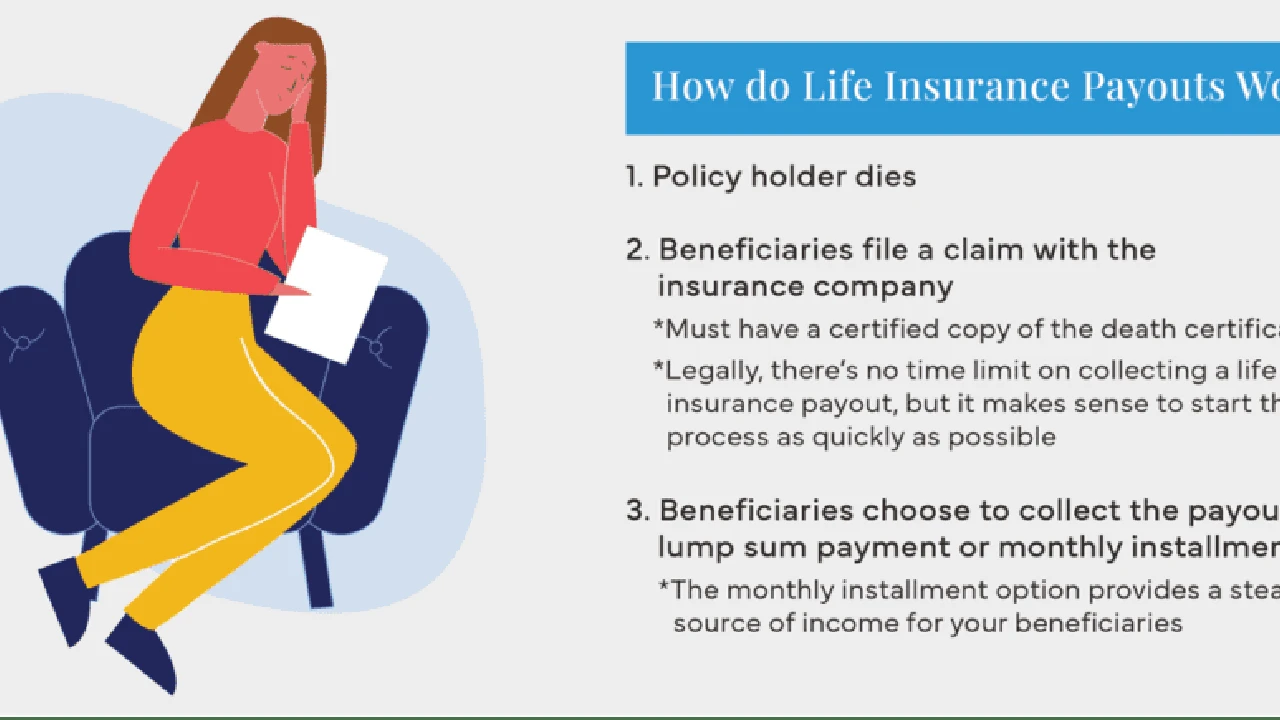

The Claim Filing Process: A Step-by-Step Guide to Life Insurance Claims

Here's the deal: filing a claim isn't rocket science, but it does require some paperwork. Here’s what you’ll typically need to do:

- Get the Death Certificate: This is the official document that proves the person has passed away. You’ll need multiple certified copies, so order a few.

- Contact the Insurance Company: Call the insurance company or visit their website. Let them know you need to file a claim. They’ll usually send you a claim form.

- Complete the Claim Form: Fill out the form accurately and completely. Double-check everything!

- Provide Documentation: Along with the claim form, you’ll need to submit the death certificate and possibly other documents like the policy itself.

- Submit the Claim: Send the completed form and documents to the insurance company. Make sure to keep copies for your records.

- Wait (Patiently): The insurance company will review your claim. This can take a few weeks or even a couple of months, depending on the complexity of the case.

Required Documentation for a Smooth Life Insurance Claim

To make things go smoothly, make sure you have these documents ready:

- Certified Death Certificate: As mentioned before, this is crucial.

- Life Insurance Policy: A copy of the original policy.

- Claim Form: Provided by the insurance company.

- Beneficiary Identification: Your driver's license, passport, or other government-issued ID.

- Proof of Relationship: If you're claiming as a spouse, you might need a marriage certificate. For other relationships, you might need birth certificates or adoption papers.

Life Insurance Payout Options Choosing the Right Method

Okay, so the insurance company approves the claim. Awesome! Now, how do you want the money? Here are the most common payout options:

- Lump Sum: You get the entire amount all at once. This is the most common and often the simplest option.

- Annuity: The money is paid out in regular installments over a set period. This can be helpful if you want a steady income stream.

- Interest Income Option: The insurance company holds the money and pays you interest on it. You can withdraw the principal later.

- Specific Income Option: You receive regular payments until the principal and interest are exhausted.

Which option is best for you? It really depends on your financial situation and goals. If you need the money right away to pay off debts, a lump sum might be the way to go. If you want a guaranteed income stream, an annuity might be better. Talk to a financial advisor to figure out what makes the most sense for you.

Factors That Can Affect the Life Insurance Payout Timeline Expediting Your Claim

Sometimes, things can slow down the payout process. Here are some factors that can cause delays:

- Contested Claims: If there's a dispute about who the beneficiary is or whether the policy should pay out, it can take longer.

- Policy Inconsistencies: If there are errors or inconsistencies in the application or policy, it can cause delays.

- Fraud Investigations: If the insurance company suspects fraud, they might investigate, which can take time.

- Waiting Periods: Some policies have waiting periods before they pay out, especially in cases of suicide.

To avoid delays, make sure the policy is accurate and up-to-date, and that all the required documentation is submitted promptly.

Understanding Taxes on Life Insurance Payouts Minimizing Your Tax Burden

Good news! Life insurance payouts are generally tax-free. That means you don't have to pay income tax on the money you receive. However, there are a few exceptions:

- Interest: If you choose an option where the insurance company holds the money and pays you interest, that interest is taxable.

- Estate Taxes: If the life insurance payout is part of a large estate, it might be subject to estate taxes.

Talk to a tax advisor to understand the tax implications of your specific situation.

Specific Life Insurance Products and Their Payout Scenarios

Term Life Insurance Payouts

Term life insurance is straightforward. It provides coverage for a specific period (e.g., 10, 20, or 30 years). If the insured person dies within that term, the beneficiary receives the payout. If the term expires and the policy isn't renewed, there's no payout. Term life is generally more affordable than whole life, making it a good option for people on a budget.

Whole Life Insurance Payouts

Whole life insurance provides coverage for the insured person's entire life. It also has a cash value component that grows over time. When the insured person dies, the beneficiary receives the death benefit. Whole life policies are typically more expensive than term life, but they offer lifelong coverage and the potential for cash value accumulation.

Universal Life Insurance Payouts

Universal life insurance is a type of permanent life insurance that offers more flexibility than whole life. The policyholder can adjust the premium payments and death benefit within certain limits. When the insured person dies, the beneficiary receives the death benefit. Universal life policies also have a cash value component that grows over time.

Comparing Life Insurance Products: Term vs Whole vs Universal

Choosing the right life insurance product depends on your individual needs and financial goals. Here's a quick comparison:

| Feature | Term Life | Whole Life | Universal Life |

|---|---|---|---|

| Coverage Duration | Specific term (e.g., 10, 20, 30 years) | Lifelong | Lifelong |

| Premium | Generally lower | Generally higher | Flexible |

| Cash Value | No | Yes | Yes |

| Flexibility | Limited | Limited | High |

| Best For | People on a budget who need coverage for a specific period | People who want lifelong coverage and cash value accumulation | People who want flexible coverage and cash value accumulation |

Recommended Life Insurance Products and Pricing

1. Haven Life Term Life Insurance

Description: Haven Life offers straightforward term life insurance policies online. They're backed by MassMutual, a well-established insurance company. Pros: Easy online application, competitive rates, no medical exam required for some applicants. Cons: Only offers term life insurance. Typical Scenario: A young family looking for affordable coverage to protect their income in case something happens to a parent. Pricing: A 30-year-old non-smoking male can get a $500,000 20-year term policy for around $25-$30 per month.

2. Northwestern Mutual Whole Life Insurance

Description: Northwestern Mutual is a highly-rated insurance company that offers a variety of life insurance products, including whole life. Pros: Strong financial strength, potential for cash value accumulation, lifelong coverage. Cons: Higher premiums compared to term life. Typical Scenario: Someone looking for lifelong coverage and a way to build cash value over time. Pricing: A 30-year-old non-smoking male can get a $500,000 whole life policy for around $400-$500 per month (depending on policy features).

3. Transamerica Universal Life Insurance

Description: Transamerica offers universal life insurance policies with flexible premiums and death benefits. Pros: Flexible premiums, potential for cash value accumulation, lifelong coverage. Cons: Can be more complex than term life. Typical Scenario: Someone looking for flexible coverage and a way to build cash value over time, with the ability to adjust premiums as needed. Pricing: A 30-year-old non-smoking male can get a $500,000 universal life policy for around $300-$400 per month (depending on policy features).

Navigating Complex Situations: Contested Claims and Disputes

Unfortunately, sometimes claims are contested. This can happen for a variety of reasons:

- Misrepresentation: The insurance company might claim the insured person misrepresented information on the application.

- Policy Lapse: The policy might have lapsed due to non-payment of premiums.

- Cause of Death: The cause of death might be excluded under the policy terms (e.g., suicide within the first two years).

If your claim is contested, don't give up. Get legal advice from an attorney who specializes in life insurance claims. They can help you understand your rights and fight for the benefits you deserve.

Seeking Professional Advice: When to Consult an Attorney or Financial Advisor

Dealing with a life insurance payout can be emotionally and financially challenging. Don't hesitate to seek professional advice if you need it.

- Attorney: If your claim is contested or you have legal questions.

- Financial Advisor: If you need help managing the payout or making financial decisions.

- Tax Advisor: If you have questions about the tax implications of the payout.

Final Thoughts on Life Insurance Payout

Understanding the life insurance payout process is crucial for beneficiaries. By knowing what to expect, you can navigate the process with confidence and ensure a smooth and efficient payout. Remember to gather all the necessary documentation, choose the right payout option, and seek professional advice if needed.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)