How to Appeal a Health Insurance Denial

Navigating the travel insurance claim process can be confusing. This step-by-step guide walks you through the process from start to finish. Learn how to file a claim, gather documentation, and get the settlement you deserve.

Understanding Your Travel Insurance Policy for a Smooth Claim Process

Okay, so you've had a travel mishap – bummer! Whether it's a lost suitcase, a sudden illness, or a canceled flight, dealing with travel insurance claims can feel overwhelming. But don't sweat it. This guide will break down the entire process, making it as painless as possible. The first and most crucial step? Dig out your travel insurance policy and *actually* read it. Yeah, I know, it's boring, but understanding what's covered (and, more importantly, what's *not*) is key to a successful claim.

Look for sections on:

- Coverage Limits: How much will the insurance company pay for each type of claim?

- Deductibles: How much do you have to pay out of pocket before the insurance kicks in?

- Exclusions: What situations aren't covered (e.g., pre-existing conditions, extreme sports without the right add-ons)?

- Claim Filing Deadlines: How long after the incident do you have to file a claim?

- Required Documentation: What documents do you need to provide to support your claim?

Knowing these details upfront will save you time and frustration later on.

Step 1 Document Everything for Your Travel Insurance Claim

As soon as something goes wrong, start documenting! Think of yourself as a travel insurance detective gathering evidence. The more proof you have, the better your chances of getting your claim approved. This means:

- Keep Receipts: Every expense related to the incident. Hotel bills, medical bills, replacement clothing, transportation – keep it all!

- Get Police Reports: If your belongings were stolen, file a police report immediately. This is often a requirement for theft claims.

- Obtain Medical Records: If you had to see a doctor, get copies of your medical records and bills.

- Keep Flight Delay/Cancellation Notices: If your flight was delayed or canceled, get written confirmation from the airline.

- Take Photos and Videos: If possible, take photos or videos of the damage or incident (e.g., a broken suitcase, a flooded hotel room).

- Collect Contact Information: Get the names and contact details of anyone who witnessed the incident or provided assistance.

Store all your documents in a safe place, both physically and digitally (e.g., scan them and save them to the cloud). A little organization goes a long way!

Step 2 Contact Your Travel Insurance Provider Immediately to Start Your Claim

Don't wait until you get home to contact your travel insurance provider. Call them as soon as possible after the incident. This allows them to guide you through the claim process and provide any necessary assistance. When you call, be prepared to provide the following information:

- Your Policy Number: You'll find this on your insurance policy document.

- A Brief Description of the Incident: Explain what happened, when it happened, and where it happened.

- Your Contact Information: Phone number and email address.

- Any Questions You Have: Don't be afraid to ask questions about the claim process.

Make a note of the date and time you called, as well as the name of the person you spoke with. This can be helpful if you need to follow up later.

Step 3 Complete the Travel Insurance Claim Form Accurately and Thoroughly

Your travel insurance provider will likely send you a claim form to complete. Read the instructions carefully and fill out all the required fields accurately and thoroughly. Don't leave anything blank! If you're unsure about something, contact your insurance provider for clarification. Attach all the supporting documentation you've gathered (receipts, police reports, medical records, etc.) to the claim form. Make sure you have copies of everything before you submit it.

Double-check the claim form for any errors or omissions before you send it in. A mistake could delay the processing of your claim.

Step 4 Submit Your Travel Insurance Claim and Track Its Progress

Once you've completed the claim form and gathered all the necessary documentation, submit it to your travel insurance provider. Follow their instructions for submitting the claim (e.g., mail it to a specific address, upload it to their website). Keep a record of when and how you submitted the claim. Many insurance providers have online portals where you can track the progress of your claim. Check the portal regularly for updates. If you don't have access to an online portal, contact your insurance provider by phone or email to inquire about the status of your claim.

Step 5 Cooperate With the Travel Insurance Adjuster During the Investigation

After you submit your claim, a travel insurance adjuster will likely be assigned to investigate it. The adjuster may contact you to ask for more information or clarification. Be cooperative and respond to their requests promptly. Provide any additional documentation they require. The adjuster may also need to contact third parties, such as airlines or hospitals, to verify your claim. Be patient and allow them time to complete their investigation.

Step 6 Understand Your Rights and Options if Your Travel Insurance Claim Is Denied

Unfortunately, not all travel insurance claims are approved. If your claim is denied, don't give up! You have the right to appeal the decision. Review the denial letter carefully to understand the reasons why your claim was rejected. Gather any additional evidence that supports your claim. Write a letter of appeal to your insurance provider, explaining why you believe the denial was incorrect. Include any new information or documentation that you have. If your appeal is denied, you may have the option to file a complaint with a consumer protection agency or take legal action. Consult with an attorney to discuss your options.

Tips for a Successful Travel Insurance Claim Experience

- Read Your Policy Carefully: Know what's covered and what's not.

- Document Everything: Keep receipts, police reports, medical records, etc.

- Contact Your Insurance Provider Immediately: Don't wait until you get home.

- Complete the Claim Form Accurately and Thoroughly: Don't leave anything blank.

- Cooperate With the Adjuster: Respond to their requests promptly.

- Be Patient: The claim process can take time.

- Understand Your Rights: Know your options if your claim is denied.

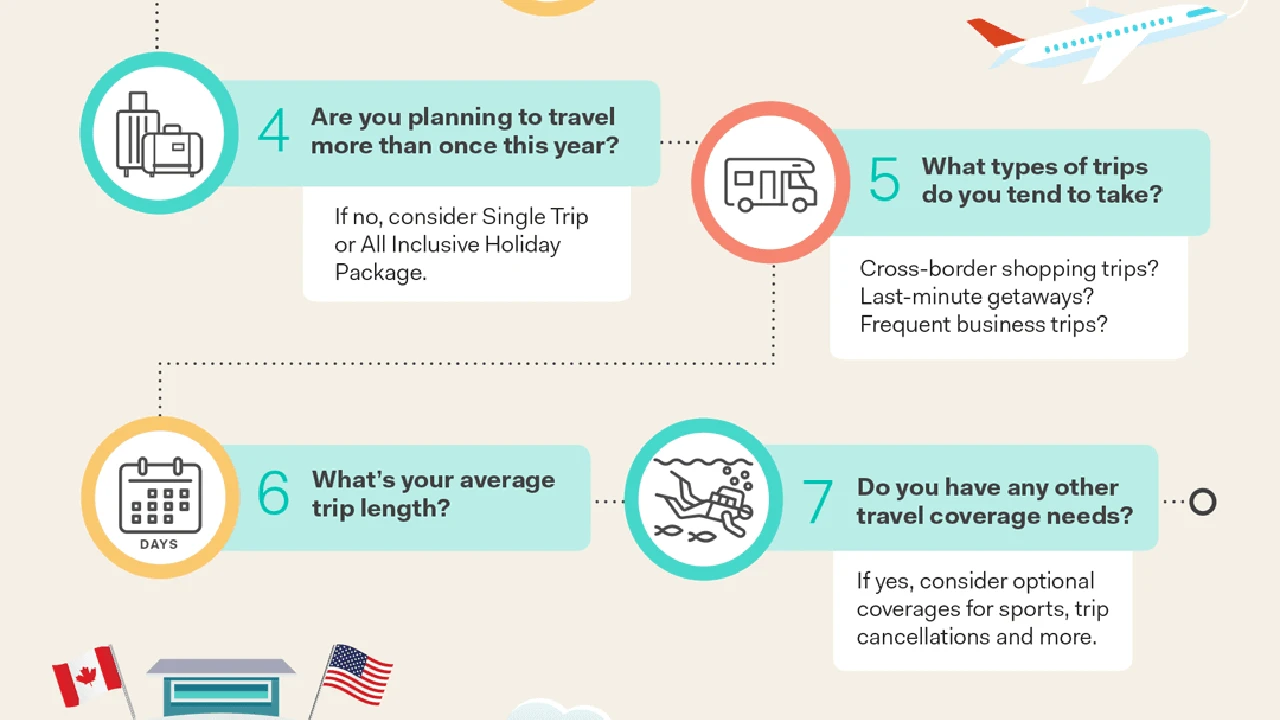

Recommended Travel Insurance Products and Scenarios for Claim Filing

1. Allianz Travel Insurance: Trip Cancellation and Interruption

Scenario: You booked a non-refundable vacation package to Europe, but you suddenly contract a severe illness that prevents you from traveling. You need to cancel your trip and recover your expenses.

Coverage: Allianz Travel Insurance offers comprehensive trip cancellation and interruption coverage that can reimburse you for non-refundable trip costs if you have to cancel or interrupt your trip due to a covered reason, such as illness, injury, or death of a family member.

Claim Filing: You'll need to provide medical documentation from your doctor, proof of your non-refundable trip expenses (e.g., airline tickets, hotel reservations), and a completed claim form. Contact Allianz immediately to start the claim process.

Product Comparison: Allianz offers different tiers of travel insurance plans, with varying levels of coverage and pricing. Consider the "Allianz Global Assistance Premier Plan" for robust trip cancellation and interruption benefits. Compare this with "Basic Plan" to see the difference in coverage limits and covered reasons.

Price: Prices vary widely depending on the trip cost, traveler age, and chosen coverage. A plan for a $5,000 trip for a 40-year-old might range from $200 to $500.

2. World Nomads Travel Insurance: Medical Emergencies and Evacuation

Scenario: You're hiking in the Himalayas and suffer a serious injury that requires emergency medical treatment and evacuation to a hospital.

Coverage: World Nomads Travel Insurance specializes in adventure travel and offers coverage for medical emergencies, evacuation, and repatriation. They can arrange for medical transport, cover hospital bills, and even fly you home if necessary.

Claim Filing: Contact World Nomads' 24/7 emergency assistance hotline immediately. They will help coordinate your medical care and evacuation. You'll need to provide medical documentation, receipts for medical expenses, and a completed claim form.

Product Comparison: World Nomads offers two main plans: "Standard Plan" and "Explorer Plan." The Explorer Plan provides higher coverage limits for medical expenses and evacuation, as well as coverage for certain adventure activities that are excluded from the Standard Plan.

Price: Coverage for a 2-week trip focused on moderate hiking can be estimated at around $100-$200. The "Explorer Plan" may cost up to double that amount.

3. Travel Guard Travel Insurance: Baggage Loss and Delay

Scenario: Your luggage is lost by the airline, and you're stranded without your belongings for several days.

Coverage: Travel Guard Travel Insurance provides coverage for baggage loss, delay, and damage. They can reimburse you for the cost of replacing lost or stolen items, as well as provide reimbursement for essential items you need to purchase while your luggage is delayed.

Claim Filing: File a claim with the airline immediately. Obtain a written confirmation of the baggage loss or delay. Keep receipts for any essential items you purchase. Submit a claim to Travel Guard with the airline documentation, receipts, and a completed claim form.

Product Comparison: Travel Guard offers a variety of plans, including those that focus on baggage coverage. Compare their "Deluxe Plan" with their "Essential Plan" to see the differences in baggage loss and delay benefits.

Price: Baggage-focused plans can be more budget-friendly, costing perhaps $50-$150 for a typical trip, depending on the coverage limits.

4. Travelex Insurance Services: Rental Car Damage

Scenario: You rent a car on vacation, and it's damaged in an accident.

Coverage: Travelex Insurance Services offers rental car damage coverage that can reimburse you for the cost of repairing or replacing the damaged vehicle. This can save you from having to pay the often-expensive collision damage waiver offered by the rental car company.

Claim Filing: Obtain a police report if the accident involves another vehicle. Collect all documentation from the rental car company, including the rental agreement, damage report, and repair estimate. Submit a claim to Travelex with the police report, rental car documentation, and a completed claim form.

Product Comparison: Travelex offers various travel insurance plans, some with more comprehensive coverage than others. Make sure the plan you choose includes rental car damage coverage.

Price: Standalone rental car insurance policies through Travelex can be very affordable, often costing less than $10 per day.

5. Seven Corners Travel Insurance: Pre-existing Medical Conditions

Scenario: You have a pre-existing medical condition and experience a flare-up while traveling that requires medical treatment.

Coverage: Seven Corners Travel Insurance offers plans that may cover pre-existing medical conditions if certain requirements are met (e.g., the condition is stable for a certain period before the trip). They can cover medical expenses related to the pre-existing condition.

Claim Filing: Provide detailed medical documentation from your doctor, including information about your pre-existing condition and the treatment you received while traveling. Submit a claim to Seven Corners with the medical documentation and a completed claim form.

Product Comparison: The "Liaison Continent" plan and other Seven Corners plans often have options to cover pre-existing conditions. Be sure to carefully review the policy's terms and conditions to understand the coverage requirements and limitations.

Price: Coverage for pre-existing conditions will generally increase the cost of your travel insurance. Expect to pay a premium compared to plans that exclude pre-existing conditions.

A Quick Comparison of Travel Insurance Providers

| Provider | Strengths | Weaknesses | Good For |

|---|---|---|---|

| Allianz Travel Insurance | Comprehensive trip cancellation, established reputation | Can be pricier than other options | Travelers seeking robust trip cancellation and interruption coverage |

| World Nomads Travel Insurance | Adventure travel coverage, 24/7 emergency assistance | May not be the cheapest option | Adventurous travelers seeking medical and evacuation coverage |

| Travel Guard Travel Insurance | Baggage coverage, wide range of plans | Customer service reviews can vary | Travelers concerned about lost or delayed baggage |

| Travelex Insurance Services | Rental car damage coverage, affordable options | May not offer the most comprehensive coverage | Travelers renting cars who want to avoid expensive CDW |

| Seven Corners Travel Insurance | Coverage for pre-existing conditions (in some cases) | Policy requirements for pre-existing conditions can be strict | Travelers with pre-existing medical conditions |

Disclaimer: Prices and coverage options are subject to change. Always compare quotes and read the policy terms and conditions carefully before purchasing travel insurance.

Key Takeaways for a Hassle-Free Travel Insurance Claim

Filing a travel insurance claim doesn't have to be a nightmare. By understanding your policy, documenting everything, and following the steps outlined above, you can increase your chances of a successful outcome. Remember to be patient, cooperative, and persistent. And don't be afraid to ask for help if you need it. Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

: A Guide.webp)