Car Insurance Discounts: 15 Ways to Lower Your Rate

Seniors often have unique travel insurance needs. Learn about travel insurance options specifically designed for seniors, considering factors like pre-existing conditions and medical coverage. Travel with peace of mind.

Understanding the Unique Travel Insurance Needs of Seniors

Alright, let's talk travel insurance for seniors. It's not quite the same game as it is for younger folks, right? As we get more seasoned, our bodies and health situations change. This means the things we need to consider when buying travel insurance are a bit different too. We're not just worried about lost luggage; we're thinking about pre-existing conditions, potential medical emergencies, and making sure we're covered if something unexpected happens on our trip. This guide is designed to help seniors and their families navigate the often-confusing world of travel insurance and find the best coverage for their specific needs.

Key Considerations for Senior Travel Insurance Policies

So, what should seniors be looking for in a travel insurance policy? Here's a breakdown of the most important factors:

Pre-Existing Medical Conditions and Senior Travel Insurance

This is a big one. Many standard travel insurance policies have exclusions for pre-existing conditions. That means if you have a heart condition, diabetes, or any other health issue you've been diagnosed with, you might not be covered for related medical expenses if something flares up during your trip. The good news is that you *can* find policies that cover pre-existing conditions. You might need to pay a higher premium, or the policy might have a "stability period" requirement (meaning your condition has to be stable for a certain amount of time before your trip). It's crucial to be honest about your medical history when applying for insurance.

Medical Coverage and Emergency Assistance for Senior Travelers

Make sure your policy has adequate medical coverage. This should include coverage for doctor visits, hospital stays, emergency medical evacuation, and repatriation (getting you back home if you need medical care). Check the policy limits carefully to make sure they're high enough to cover potential medical expenses in the countries you're visiting. Also, look for a policy that offers 24/7 emergency assistance. This means you can call a dedicated helpline anytime, day or night, if you need help finding a doctor, arranging transportation, or dealing with a medical emergency.

Trip Cancellation and Interruption Coverage for Senior Citizens

Life happens. You might have to cancel your trip due to illness, injury, or a family emergency. Trip cancellation coverage can reimburse you for non-refundable trip expenses if you have to cancel for a covered reason. Trip interruption coverage can reimburse you if your trip is interrupted after it's already started. Again, check the policy limits and covered reasons carefully.

Baggage and Personal Belongings Protection for Elderly Travelers

While medical emergencies are the biggest concern, it's still important to protect your baggage and personal belongings. Baggage coverage can reimburse you if your luggage is lost, stolen, or damaged. Personal belongings coverage can reimburse you if your personal items are lost or stolen. Make sure the policy limits are high enough to cover the value of your belongings.

Travel Insurance and Age Limits for Older Adults

Some travel insurance companies have age limits. This means they might not offer coverage to people over a certain age. If you're over 70 or 80, you might need to shop around to find a policy that will cover you. Also, be aware that premiums tend to increase with age.

Specific Travel Insurance Products Recommended for Seniors

Okay, let's get down to some specific recommendations. These are just a few examples, and it's always best to compare quotes from multiple companies before making a decision.

Product 1: Allianz Global Assistance Comprehensive Plan

Description: This plan offers comprehensive coverage for seniors, including coverage for pre-existing conditions (with a stability period), high medical coverage limits, trip cancellation and interruption coverage, and baggage protection.

Use Case: Ideal for seniors taking longer trips or traveling to countries with high medical costs.

Comparison: Compared to basic plans, this one offers much broader coverage, especially for pre-existing conditions. Compared to more expensive plans, it's a good value for the level of coverage it provides.

Price: Prices vary depending on age, trip length, and destination, but you can expect to pay around $200-$500 for a two-week trip for a senior with pre-existing conditions.

Product 2: World Nomads Explorer Plan (with limitations for seniors)

Description: World Nomads is a popular choice for adventure travelers, but their Explorer Plan can also be suitable for active seniors. It offers good medical coverage, trip cancellation and interruption coverage, and coverage for some adventure activities.

Use Case: Best for seniors who are planning active trips, such as hiking, cycling, or kayaking.

Comparison: World Nomads is often more affordable than some of the more specialized senior travel insurance companies. However, it may have stricter limitations on pre-existing conditions and age. Always check the policy wording carefully.

Price: Prices are generally lower than Allianz, ranging from $150-$300 for a two-week trip, but the coverage may be less comprehensive.

Product 3: Travel Guard Essential Plan

Description: This plan offers a good balance of affordability and coverage for seniors. It includes medical coverage, trip cancellation and interruption coverage, and baggage protection.

Use Case: A solid option for seniors who want basic coverage without breaking the bank.

Comparison: Travel Guard is known for its customer service. The Essential Plan offers a good level of protection, but may not cover all pre-existing conditions.

Price: Prices are typically in the $100-$250 range for a two-week trip, making it a budget-friendly option.

Comparing Travel Insurance Companies for Senior Citizens

Choosing the right travel insurance company is just as important as choosing the right policy. Here are a few things to consider when comparing companies:

Company Reputation and Customer Service Ratings

Read online reviews and check customer service ratings to get a sense of the company's reputation. Look for companies that are known for being responsive, helpful, and fair when handling claims.

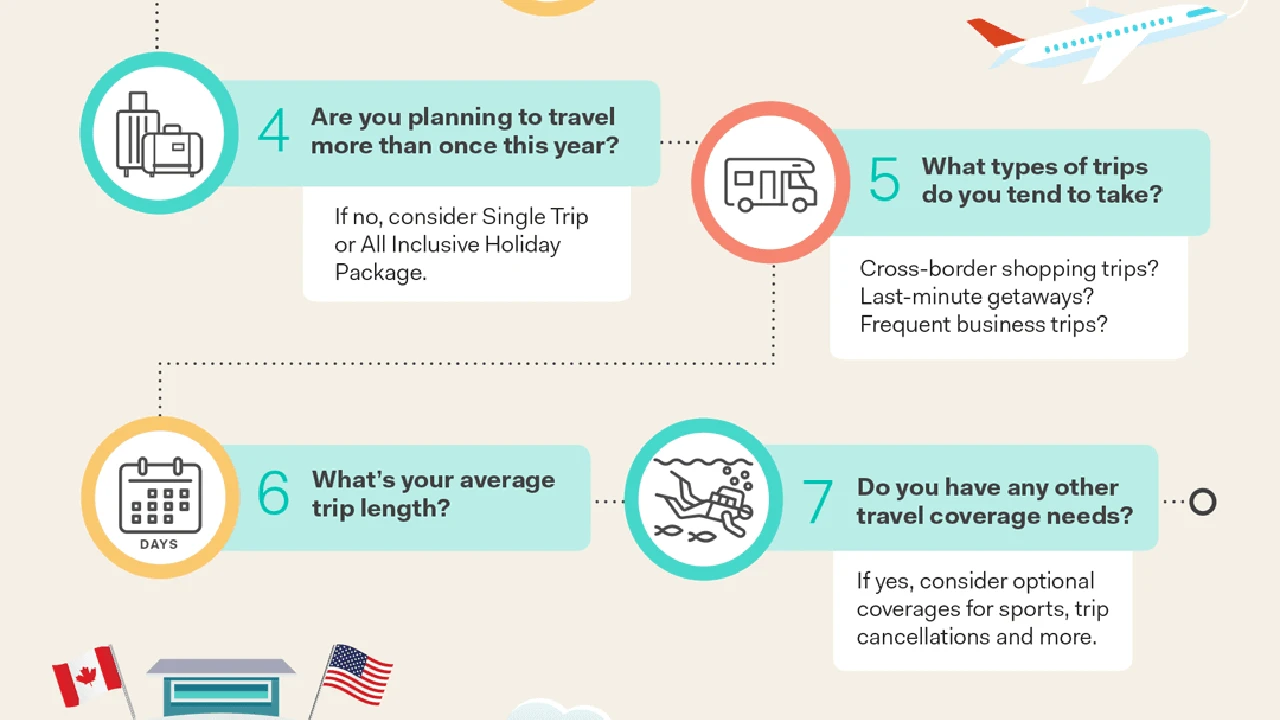

Policy Options and Customization Possibilities for Older Travelers

Does the company offer a variety of policy options to choose from? Can you customize your policy to fit your specific needs? The more options you have, the better chance you'll have of finding a policy that's right for you.

Claim Process and Payout Speed for Senior Travel Insurance

Find out how easy it is to file a claim and how quickly the company typically pays out claims. A complicated claim process can be frustrating, especially if you're dealing with a medical emergency.

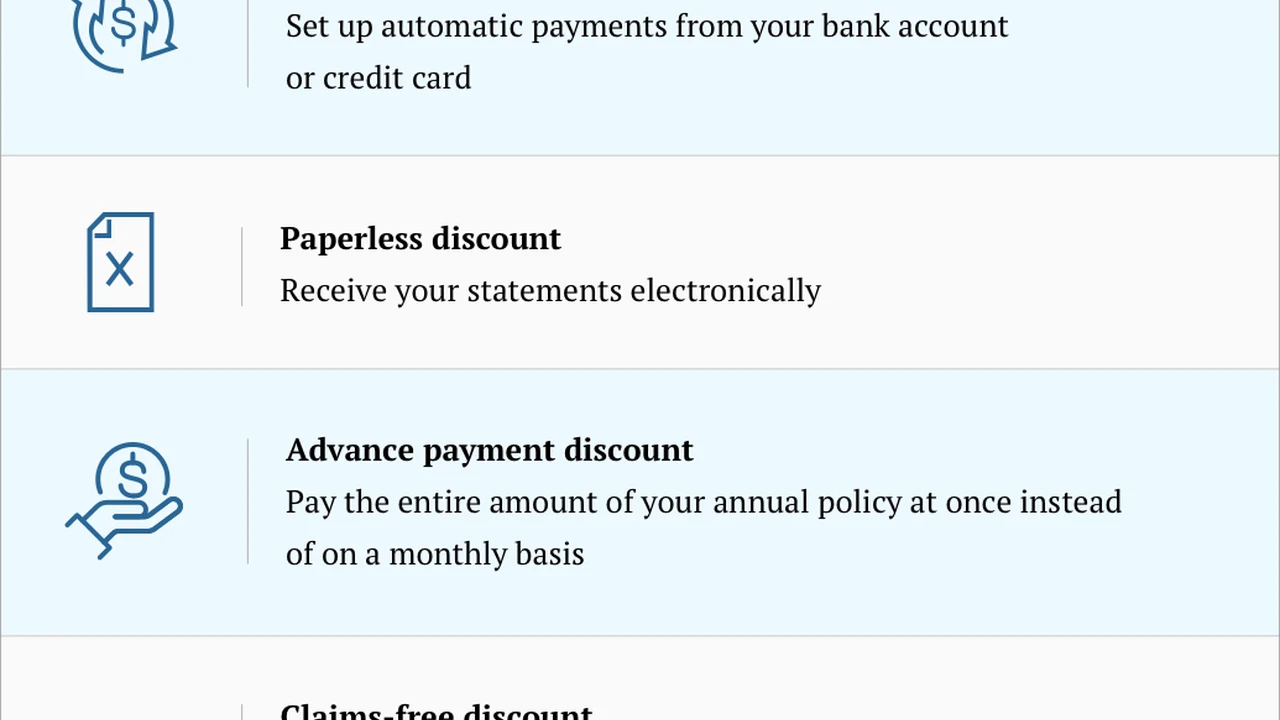

Tips for Finding Affordable Travel Insurance for Seniors

Travel insurance can be expensive, especially for seniors with pre-existing conditions. Here are a few tips for finding affordable coverage:

Shop Around and Compare Quotes from Multiple Providers

Don't just settle for the first quote you get. Shop around and compare quotes from multiple companies to see who offers the best rates. Websites like InsureMyTrip and Squaremouth can help you compare quotes from different providers.

Increase Your Deductible for Lower Premiums

Increasing your deductible can lower your premium. However, make sure you can afford to pay the deductible if you need to file a claim.

Consider an Annual Travel Insurance Plan If You Travel Frequently

If you travel frequently, an annual travel insurance plan might be more cost-effective than buying separate policies for each trip.

Travel within Your Health Insurance Network

If you're traveling within your health insurance network, you might not need as much medical coverage from your travel insurance policy.

Understanding Travel Insurance Exclusions for Senior Travelers

It's crucial to understand the exclusions in your travel insurance policy. Exclusions are situations that the policy won't cover. Common exclusions include:

Acts of War and Terrorism

Most travel insurance policies don't cover losses caused by acts of war or terrorism.

Participation in Illegal Activities

If you're injured while participating in illegal activities, your policy won't cover your medical expenses.

Traveling Against Medical Advice

If you're traveling against medical advice, your policy might not cover any medical expenses related to your condition.

Pre-Existing Conditions Not Disclosed

If you fail to disclose a pre-existing condition when applying for insurance, your policy might be voided, and you won't be covered for anything related to that condition.

How to File a Travel Insurance Claim A Step-by-Step Guide for Seniors

Okay, so you've had a mishap on your trip and need to file a claim. Here's a step-by-step guide to make the process as smooth as possible:

Step 1: Gather All Necessary Documentation

This includes your policy number, medical records, receipts for expenses, and any other documents that support your claim.

Step 2: Contact Your Travel Insurance Company

Call the company's customer service line or visit their website to start the claim process.

Step 3: Fill Out the Claim Form

Complete the claim form accurately and provide all the required information.

Step 4: Submit Your Claim

Submit your claim form and all supporting documentation to the insurance company.

Step 5: Follow Up with the Insurance Company

Check the status of your claim regularly and respond to any requests for additional information.

Final Thoughts on Travel Insurance for Seniors

Choosing the right travel insurance policy can be a bit overwhelming, but it's essential for ensuring a safe and enjoyable trip. By understanding your specific needs, comparing policy options, and shopping around for the best rates, you can find coverage that gives you peace of mind while you're on the road. Don't hesitate to contact a travel insurance professional for personalized advice. They can help you navigate the complexities of travel insurance and find a policy that's right for you. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)