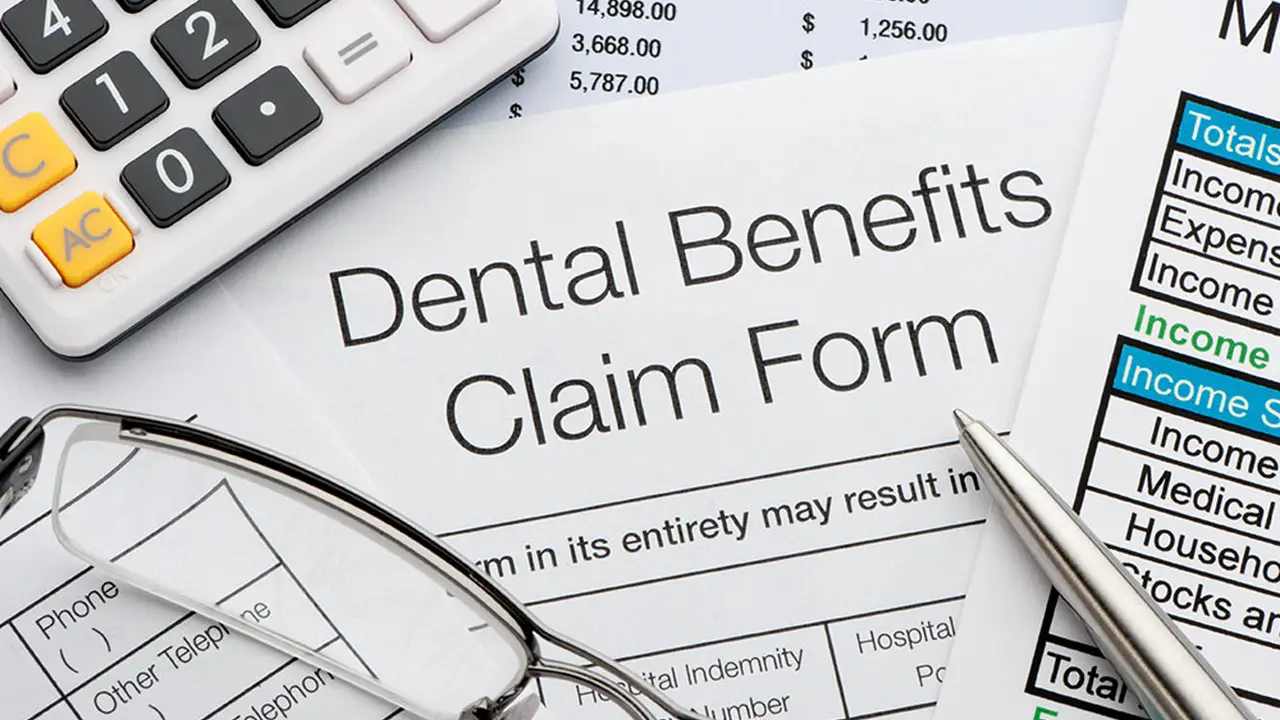

Dental Insurance: Is It Worth the Cost?

Dental insurance can help cover the cost of dental care. Evaluate the value of dental insurance based on your oral health needs and potential expenses. Decide if a dental insurance plan is right for you and your family.

Understanding Dental Insurance Basics Dental Coverage Options

Okay, let's dive into the world of dental insurance. It's one of those things many people wonder about: Is it really worth the money? You see those monthly premiums, and you wonder if you're just throwing money away. Well, it's not that simple. Dental insurance is designed to help you cover the costs associated with dental care, from routine check-ups to more complex procedures. But the real question is, does it make sense for *you*?

First, let’s understand the basics. Think of dental insurance like a safety net for your teeth. You pay a monthly premium (like a subscription fee), and in return, the insurance company helps pay for dental services. The amount they pay and what they cover depends on your specific plan.

There are a few main types of dental insurance plans you’ll typically encounter:

- Dental HMO (DHMO): These plans usually require you to choose a primary care dentist from their network. You'll need a referral to see a specialist. DHMOs often have lower premiums but less flexibility.

- Dental PPO (DPPO): These plans offer more flexibility. You can see any dentist you want, but you'll usually pay less if you stay within the PPO network. Premiums are generally higher than DHMOs.

- Indemnity Plans (Fee-for-Service): These plans are the most flexible. You can see any dentist without needing a referral, and there's usually no network. However, they often have higher premiums and may require you to pay upfront and then get reimbursed.

- Discount Dental Plans: These aren't actually insurance. You pay a membership fee to access a network of dentists who offer discounted rates.

What Dental Insurance Typically Covers Preventative Care and Major Procedures

So, what exactly does dental insurance cover? Most plans follow a similar structure, dividing coverage into different categories:

- Preventive Care: This includes routine check-ups, cleanings, and X-rays. Most dental insurance plans cover 100% of preventive care, which is a huge benefit. These regular visits are crucial for catching problems early and preventing more serious (and expensive) issues down the road.

- Basic Procedures: This category includes things like fillings, simple extractions, and sometimes root canals on front teeth. Coverage for basic procedures is usually around 80%.

- Major Procedures: This includes more complex procedures like crowns, bridges, dentures, implants, and root canals on molars. Coverage for major procedures is typically around 50%.

It's *really* important to read the fine print of your policy. Pay attention to things like:

- Annual Maximum: This is the maximum amount the insurance company will pay for your dental care in a year. Once you reach this limit, you're responsible for paying the rest out of pocket.

- Deductible: This is the amount you need to pay out of pocket before your insurance starts covering costs.

- Waiting Periods: Many plans have waiting periods before certain procedures are covered. For example, you might have to wait six months for basic procedures and a year for major procedures.

- Exclusions: Some plans may exclude certain procedures or treatments, such as cosmetic dentistry or orthodontics.

Evaluating Your Dental Needs Assessing Oral Health and Potential Expenses

Okay, so you know the basics of dental insurance. Now, how do you decide if it's worth it for *you*? The key is to evaluate your individual needs and circumstances.

Start by assessing your oral health. Are you someone who generally has good teeth and only needs routine cleanings and check-ups? Or do you have a history of cavities, gum disease, or other dental problems? If you're prone to dental issues, insurance might be a worthwhile investment.

Consider your potential dental expenses. Think about the types of procedures you might need in the future. Do you have any existing dental problems that need to be addressed? Are you likely to need crowns, bridges, or implants? The more potential expenses you foresee, the more valuable dental insurance might be.

Also, think about your budget. Can you comfortably afford the monthly premiums and any out-of-pocket costs like deductibles and co-pays? If the premiums are a stretch for your budget, it might not be the right choice, even if you could benefit from the coverage.

Here's a simple breakdown to help you decide:

- Good Oral Health, Low Risk: If you have excellent oral health and rarely need dental work, you might be better off paying out of pocket for routine care.

- Moderate Oral Health, Moderate Risk: If you have occasional dental problems, insurance could be a good way to budget for those expenses.

- Poor Oral Health, High Risk: If you have significant dental problems or a history of extensive dental work, insurance is likely a necessity.

Comparing Dental Insurance Plans Finding the Best Value for Your Money

If you decide that dental insurance is right for you, the next step is to compare different plans and find the best value for your money. Don't just go with the first plan you see. Take the time to research and compare your options.

Here are some key factors to consider when comparing dental insurance plans:

- Premiums: How much will you pay each month for coverage?

- Deductibles: How much will you need to pay out of pocket before your insurance starts covering costs?

- Annual Maximum: What's the maximum amount the insurance company will pay in a year?

- Coverage Percentages: What percentage of costs does the plan cover for preventive, basic, and major procedures?

- Waiting Periods: How long do you have to wait before certain procedures are covered?

- Network: Does the plan have a network of dentists? If so, is your current dentist in the network?

- Exclusions: Are there any procedures or treatments that are not covered by the plan?

Use online tools and resources to compare different plans. Many insurance companies offer online quote tools that allow you to compare premiums, coverage, and other features. You can also check out independent review sites and consumer reports to get unbiased information about different plans.

Specific Dental Insurance Products and Their Use Cases

Let's get down to brass tacks and look at some specific dental insurance products. Remember, prices and availability can change, so always double-check with the insurance company directly.

Delta Dental PPO Plus Premier

Use Case: This is a solid all-around plan for people who want flexibility and a wide network of dentists. It's a PPO, so you don't need a referral to see a specialist, and you can go to any dentist, although you'll save money by staying in the Delta Dental network.

Coverage: Typically covers 100% of preventive care, 80% of basic procedures, and 50% of major procedures.

Network: One of the largest dental networks in the US.

Estimated Cost: Premiums can range from $40 to $80 per month, depending on your location and coverage level.

Pros: Large network, good coverage percentages, no referrals needed.

Cons: Premiums can be higher than some other plans.

Cigna Dental 1500

Use Case: A good option for people who anticipate needing major dental work. It has a higher annual maximum than many other plans, which can be a lifesaver if you need expensive procedures like implants or crowns.

Coverage: 100% preventive, 80% basic, 50% major.

Network: Cigna has a decent network, but it's not as extensive as Delta Dental.

Estimated Cost: Premiums around $50-$90 per month.

Pros: High annual maximum, good coverage.

Cons: Network may not be as large as other providers.

Humana Complete Dental

Use Case: Humana often has plans that are appealing to seniors or those looking for comprehensive coverage. Their Complete Dental plan is designed to cover a wide range of services.

Coverage: Varies depending on the specific plan, but generally covers preventive, basic, and major services.

Network: Humana has a national network of dentists.

Estimated Cost: Prices vary widely, so get a quote based on your specific needs.

Pros: Wide range of coverage options.

Cons: Can be more expensive.

Aetna Dental Direct

Use Case: Aetna Dental Direct is a discount plan, not insurance. It provides access to discounted rates at participating dentists. This can be a good option if you don't need comprehensive coverage and primarily want to save money on routine care.

Coverage: Not insurance, so no coverage percentages. You pay discounted rates at participating dentists.

Network: Aetna has a network of participating dentists.

Estimated Cost: Membership fees are typically around $10-$20 per month.

Pros: Low cost, access to discounted rates.

Cons: Not insurance, so doesn't cover a percentage of costs.

Dental Insurance Product Comparison Chart: Features and Pricing

To give you a clearer picture, here’s a comparison chart:

| Company | Plan Type | Preventive | Basic | Major | Annual Max | Approx. Monthly Premium | Network Size |

|---|---|---|---|---|---|---|---|

| Delta Dental | PPO | 100% | 80% | 50% | $1000 - $2000 | $40 - $80 | Very Large |

| Cigna | PPO | 100% | 80% | 50% | $1500 - $2500 | $50 - $90 | Large |

| Humana | PPO/DHMO | Varies | Varies | Varies | Varies | Varies | National |

| Aetna | Discount Plan | Discounted Rates | Discounted Rates | Discounted Rates | N/A | $10 - $20 | Large |

Disclaimer: These are estimated costs and coverage percentages. Actual costs and coverage may vary depending on your location, plan options, and individual circumstances. Always verify information directly with the insurance provider before making a decision.

Paying out of Pocket for Dental Care: Is it a Viable Option?

Paying out of pocket for dental care is definitely an option, especially if you have good oral health and don't anticipate needing a lot of work. However, it can be risky. A single unexpected procedure, like a root canal or a crown, can easily cost thousands of dollars. If you're not prepared for that kind of expense, it can put a serious strain on your finances.

Here are some things to consider if you're thinking about paying out of pocket:

- Create a Dental Savings Account: Set aside money each month specifically for dental expenses. This can help you cover unexpected costs without going into debt.

- Look for Dental Schools: Dental schools often offer discounted rates for treatment performed by students under the supervision of experienced dentists.

- Negotiate with Your Dentist: Don't be afraid to ask your dentist for a discount or payment plan. Many dentists are willing to work with patients who are paying out of pocket.

- Consider a CareCredit Card: CareCredit is a credit card specifically for healthcare expenses. It offers low-interest or interest-free financing options for dental procedures.

Making the Final Decision: Is Dental Insurance Right for You?

Ultimately, the decision of whether or not to get dental insurance is a personal one. There's no right or wrong answer. The best choice for you depends on your individual needs, circumstances, and budget.

Weigh the pros and cons carefully. Consider your oral health, potential dental expenses, and financial situation. Compare different plans and find the best value for your money. And don't be afraid to ask questions and seek advice from dental professionals.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)