7 Best Travel Insurance Companies: Reviews and Comparison

Traveling with pre-existing medical conditions requires careful planning. Learn how travel insurance covers pre-existing conditions, what limitations may apply, and ensure you have adequate coverage for your specific needs. Discover top travel insurance options and tips for a worry-free trip.

Understanding Pre Existing Conditions for Travel Insurance

Let's face it, nobody wants to think about worst-case scenarios when planning a vacation. But if you're traveling with a pre-existing medical condition, it's crucial to understand how travel insurance works and what kind of coverage you can realistically expect. A pre-existing condition is any health issue you've been diagnosed with or treated for before purchasing your travel insurance policy. This includes everything from diabetes and heart conditions to asthma and allergies. Travel insurance companies will want to know about these conditions because they affect the likelihood of you needing medical care while you're away.

Now, here's the thing: not all travel insurance policies automatically cover pre-existing conditions. Many policies have what's called a "look-back period." This means they'll review your medical history for a certain period (usually 60 to 180 days) before you bought the policy. If you've received treatment or medication for a pre-existing condition during that time, it might be excluded from coverage. However, don't panic! There are still plenty of options available for travelers with pre-existing conditions. The key is to do your research and find a policy that specifically addresses your needs.

Why is Travel Insurance Important for People with Pre Existing Conditions?

Imagine you're on a dream vacation, and suddenly your asthma flares up, requiring a trip to the local hospital. Without travel insurance, you could be stuck with a hefty medical bill that could easily wipe out your savings. Travel insurance for pre-existing conditions can cover a range of expenses, including:

- Emergency medical care: This includes doctor's visits, hospital stays, ambulance services, and even emergency surgery.

- Prescription medications: If you run out of your regular medication or need a new prescription, travel insurance can help cover the cost.

- Medical evacuation: If you need to be transported to a better-equipped medical facility, travel insurance can cover the expensive cost of medical evacuation.

- Trip cancellation or interruption: If your pre-existing condition flares up before your trip, preventing you from traveling, or if it requires you to cut your trip short, travel insurance can reimburse you for non-refundable travel expenses.

Beyond the financial protection, travel insurance provides peace of mind. Knowing you have coverage in case of a medical emergency allows you to relax and enjoy your trip to the fullest.

Types of Travel Insurance Policies Covering Pre Existing Conditions

Understanding the different types of travel insurance policies is essential for finding the right coverage. Here are the most common options:

- Standard Travel Insurance Policies with Pre-Existing Condition Waivers: Some standard policies offer a waiver for pre-existing conditions. To qualify, you typically need to purchase the policy within a specific timeframe (usually 14-21 days) of making your initial trip deposit. You may also need to be medically fit to travel at the time of purchase. These waivers essentially remove the pre-existing condition exclusion, providing coverage for related medical expenses.

- Specialized Travel Insurance Policies for Pre-Existing Conditions: These policies are specifically designed for people with pre-existing conditions. They often have more comprehensive coverage and may not require a look-back period. However, they tend to be more expensive than standard policies.

- Travel Insurance Policies with Exclusion Riders: An exclusion rider is an amendment to your policy that specifically excludes coverage for a particular pre-existing condition. This can be a good option if you have multiple pre-existing conditions and only want coverage for some of them.

Factors to Consider When Choosing Travel Insurance for Pre Existing Conditions

Choosing the right travel insurance policy can be overwhelming, but here are some key factors to consider:

- Your specific pre-existing conditions: What are your health issues? How stable are they? What medications are you taking? Be honest and upfront about your medical history when comparing policies.

- The policy's coverage limits: Make sure the policy's coverage limits are high enough to cover potential medical expenses. Consider the cost of medical care in the country you're visiting.

- The policy's exclusions: Carefully review the policy's exclusions to understand what's not covered. Pay close attention to exclusions related to pre-existing conditions.

- The policy's waiting periods: Some policies have waiting periods before coverage for pre-existing conditions kicks in. Be sure to purchase your policy well in advance of your trip.

- The policy's claims process: Understand how to file a claim and what documentation you'll need. Choose a policy with a straightforward and efficient claims process.

- Cost: Travel insurance for pre-existing conditions can be expensive, so compare quotes from multiple providers. Don't automatically choose the cheapest policy; prioritize coverage over price.

Top Travel Insurance Companies Offering Pre Existing Condition Coverage

Several reputable travel insurance companies offer policies that cover pre-existing conditions. Here are a few top contenders:

- World Nomads: World Nomads is a popular choice for adventure travelers, but they also offer coverage for pre-existing conditions under certain circumstances. Their Explorer plan, for example, can cover stable pre-existing conditions if you purchase the policy within 21 days of your initial trip deposit. They offer a flexible approach to coverage and are known for their easy-to-use website and claims process.

- Allianz Travel Insurance: Allianz offers a range of travel insurance policies, including some with pre-existing condition waivers. Their Prime and Executive plans, for instance, can waive the pre-existing condition exclusion if you meet certain eligibility requirements, such as purchasing the policy within 14 days of your initial trip deposit and being medically fit to travel. Allianz is a well-established company with a strong reputation for customer service.

- Travel Guard: Travel Guard is another reputable provider with a variety of travel insurance options. Their Preferred and Deluxe plans offer pre-existing condition waivers if you purchase the policy within a specific timeframe (usually 15-21 days) of your initial trip deposit. Travel Guard is known for its comprehensive coverage and 24/7 assistance services.

- Seven Corners: Seven Corners specializes in travel insurance for international travelers and offers several policies that cover pre-existing conditions. Their RoundTrip Choice plan, for example, provides coverage for stable pre-existing conditions if you meet certain requirements. Seven Corners is a good option for travelers with complex medical needs.

- MedjetAssist: While not strictly travel insurance, MedjetAssist provides medical transport and evacuation services. If you require hospitalization while traveling, MedjetAssist will transport you to a hospital of your choice, regardless of medical necessity. This can be a valuable option for travelers with serious pre-existing conditions.

Specific Travel Insurance Products and Their Features

Let's dive deeper into some specific travel insurance products and compare their features:

World Nomads Explorer Plan

Features:

- Emergency medical expenses

- Trip cancellation and interruption

- Baggage loss and delay

- 24/7 assistance services

- Coverage for stable pre-existing conditions (with waiver)

Pros: Flexible coverage options, easy-to-use website, good for adventure travelers.

Cons: Pre-existing condition waiver requirements, may not be the most comprehensive coverage for all medical needs.

Typical Price: Varies based on trip length, destination, and age, but expect to pay around $100-$300 for a 2-week trip.

Best Use Case: A healthy individual with a stable pre-existing condition going on an active vacation, such as hiking or snowboarding.

Allianz Travel Insurance Prime Plan

Features:

- Emergency medical expenses

- Trip cancellation and interruption

- Baggage loss and delay

- Pre-existing condition waiver (with eligibility requirements)

- 24/7 assistance services

Pros: Comprehensive coverage, well-established company, good customer service.

Cons: Pre-existing condition waiver requirements, may be more expensive than other options.

Typical Price: Varies based on trip length, destination, and age, but expect to pay around $150-$350 for a 2-week trip.

Best Use Case: Someone with a pre-existing condition who wants comprehensive coverage and is willing to pay a bit more for peace of mind.

Travel Guard Preferred Plan

Features:

- Emergency medical expenses

- Trip cancellation and interruption

- Baggage loss and delay

- Pre-existing condition waiver (with eligibility requirements)

- 24/7 assistance services

Pros: Wide range of coverage options, strong reputation, good for families.

Cons: Pre-existing condition waiver requirements, policy language can be complex.

Typical Price: Varies based on trip length, destination, and age, but expect to pay around $120-$320 for a 2-week trip.

Best Use Case: A family traveling with children, where one or more members have a pre-existing condition.

Comparing Travel Insurance Products for Pre Existing Conditions

When comparing these products, consider the following:

- Pre-existing condition waiver requirements: Do you meet the eligibility requirements for the waiver? If not, the policy may not cover your pre-existing condition.

- Coverage limits: Are the coverage limits high enough for your potential medical expenses?

- Exclusions: Are there any exclusions that could affect your coverage?

- Cost: How does the cost of the policy compare to other options?

- Customer reviews: What do other customers say about the company's customer service and claims process?

It's always a good idea to get quotes from multiple providers and carefully compare the policy details before making a decision.

Tips for Traveling with Pre Existing Conditions

In addition to purchasing travel insurance, here are some other tips for traveling with pre-existing conditions:

- Talk to your doctor before you travel: Get a checkup and make sure your condition is stable. Ask your doctor for a letter outlining your medical history and medications.

- Pack all your medications in their original containers: Bring enough medication to last for the entire trip, plus a few extra days in case of delays.

- Carry a list of your medications and allergies: Keep this list with you at all times.

- Research medical facilities in your destination: Know where to go in case of a medical emergency.

- Learn some basic medical phrases in the local language: This can be helpful if you need to communicate with medical professionals.

- Stay hydrated and avoid overexertion: Take care of yourself and avoid activities that could trigger your pre-existing condition.

- Be aware of your surroundings: Pay attention to potential triggers, such as allergens or air pollution.

- Travel with a companion if possible: Having someone with you can provide support and assistance in case of a medical emergency.

- Store important documents safely: Keep copies of your passport, travel insurance policy, and medical information in a separate location from the originals.

How to File a Travel Insurance Claim for a Pre Existing Condition

If you need to file a travel insurance claim for a pre-existing condition, here's what you need to do:

- Contact your insurance company as soon as possible: Let them know about the incident and ask about the claims process.

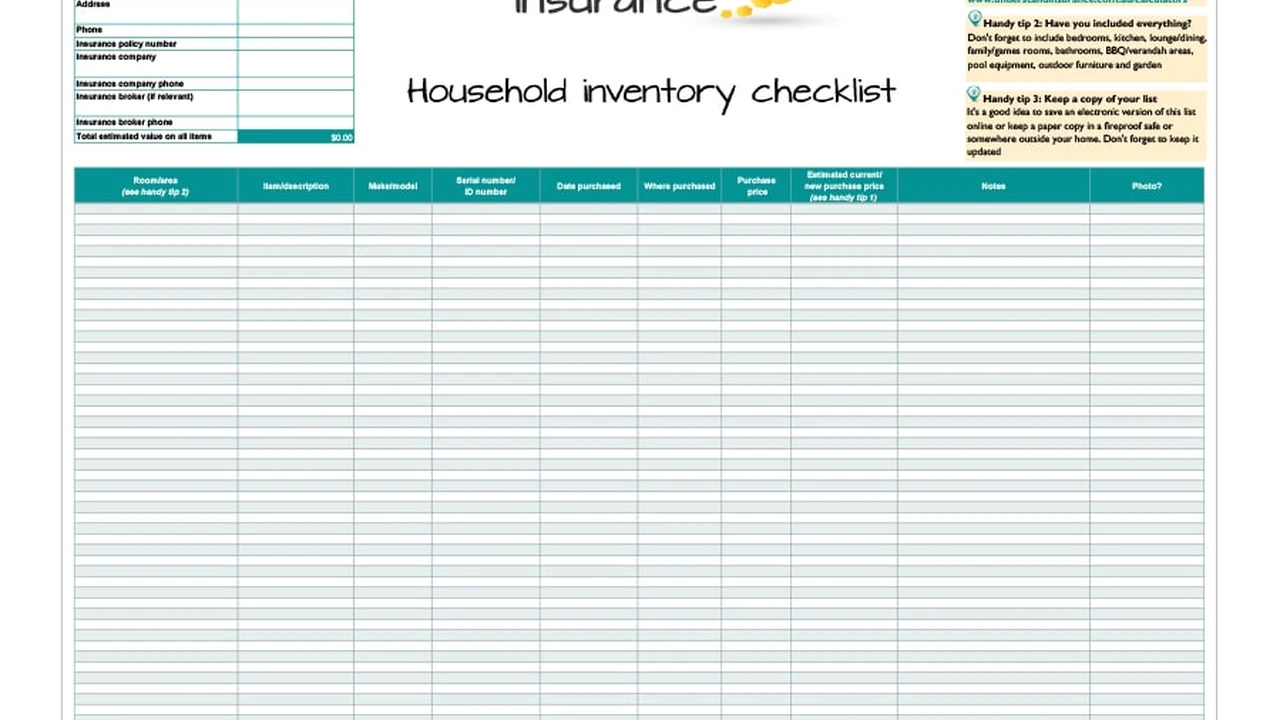

- Gather all necessary documentation: This includes your policy details, medical records, receipts for medical expenses, and any other relevant information.

- Complete the claims form: Fill out the claims form accurately and completely.

- Submit your claim: Send your claim and all supporting documentation to the insurance company.

- Follow up with the insurance company: Check on the status of your claim and respond to any requests for additional information.

Be patient and persistent. It can take time for the insurance company to process your claim. If you're not satisfied with the outcome, you may have the option to appeal the decision.

Understanding Policy Exclusions Related to Pre Existing Conditions

It's vital to be aware of common exclusions related to pre-existing conditions. Policies often exclude coverage for:

- Conditions not deemed "stable": If your condition has recently changed or requires ongoing treatment adjustments, it may not be covered.

- Routine checkups or maintenance: Travel insurance is generally for emergencies, not regular medical care.

- Treatment sought primarily for the pre-existing condition: If the main purpose of your trip is to seek treatment for your pre-existing condition, the policy is unlikely to cover it.

- Conditions that existed but weren't diagnosed: If you experienced symptoms before your trip but weren't formally diagnosed until during the trip, coverage may be denied.

Staying Informed: Resources for Travelers with Pre Existing Conditions

Here are some valuable resources to help you stay informed:

- Your doctor: They are your best source of information about your specific medical needs.

- Travel insurance company websites: Review policy details and FAQs.

- Travel blogs and forums: Read about other travelers' experiences with pre-existing conditions.

- The U.S. Department of State: Provides travel advisories and health information for destinations worldwide.

- The Centers for Disease Control and Prevention (CDC): Offers health recommendations and travel notices.

Traveling with a pre-existing condition requires careful planning and preparation. But with the right travel insurance policy and a proactive approach to your health, you can enjoy a safe and memorable trip.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)