How to File a Car Insurance Claim: A Step-by-Step Guide

Finding the right auto insurance can be challenging. We compare the top 7 auto insurance companies of 2024 based on price, coverage, and customer satisfaction. Learn which insurer fits your needs and budget best. Get a free quote today!

Step 1 Assess the Situation and Ensure Safety

Okay, so you've been in a car accident. First things first, take a deep breath. The immediate aftermath can be stressful, but staying calm is crucial. Your safety and the safety of everyone involved is paramount. Check yourself and your passengers for injuries. If anyone is hurt, call 911 immediately. Don't hesitate – even seemingly minor injuries can be serious.

Once you've addressed any immediate medical needs, move your vehicle to a safe location if possible. If your car is undrivable or poses a hazard, turn on your hazard lights and wait for assistance. Be mindful of oncoming traffic and avoid putting yourself or others at risk.

Step 2 Document the Scene Gather Information and Evidence

This is where being prepared really pays off. Grab your phone or a camera (if you have one) and start documenting everything. Take photos and videos of:

- The Damage: Capture all angles of the damage to your vehicle and the other vehicle(s) involved. Focus on the extent of the damage, any visible debris, and the positioning of the cars.

- The Scene: Take photos of the entire accident scene, including road conditions, traffic signs, and any relevant landmarks. This can help provide context and support your claim.

- The Other Vehicle(s): Get clear photos of the other vehicle(s) involved, including their license plates.

Next, gather essential information from the other driver(s):

- Name and Contact Information: Get their full name, phone number, and address.

- Driver's License Information: Note down their driver's license number and the issuing state.

- Insurance Information: Obtain their insurance company name, policy number, and expiration date. This is critical for filing your claim.

- Vehicle Information: Record the make, model, and year of their vehicle.

If there are any witnesses to the accident, try to get their contact information as well. Their statements can be invaluable in supporting your claim, especially if there's a dispute about who was at fault.

Step 3 Contact the Police and File a Report

In many cases, it's necessary to contact the police and file a police report, especially if:

- There are injuries or fatalities.

- The damage exceeds a certain threshold (varies by state).

- There's a dispute about who was at fault.

- The other driver is uninsured or flees the scene.

Even if none of these conditions apply, it's often a good idea to file a police report, as it provides an official record of the accident. The police report will include details about the accident, the parties involved, and any contributing factors. Obtain a copy of the police report for your records, as your insurance company will likely need it.

Step 4 Notify Your Insurance Company Immediately

Don't delay in contacting your insurance company. Most policies require you to report accidents promptly, regardless of who was at fault. Contact your insurance agent or the claims department and provide them with the following information:

- Your policy number.

- The date, time, and location of the accident.

- A brief description of what happened.

- The other driver's information (if applicable).

- The police report number (if applicable).

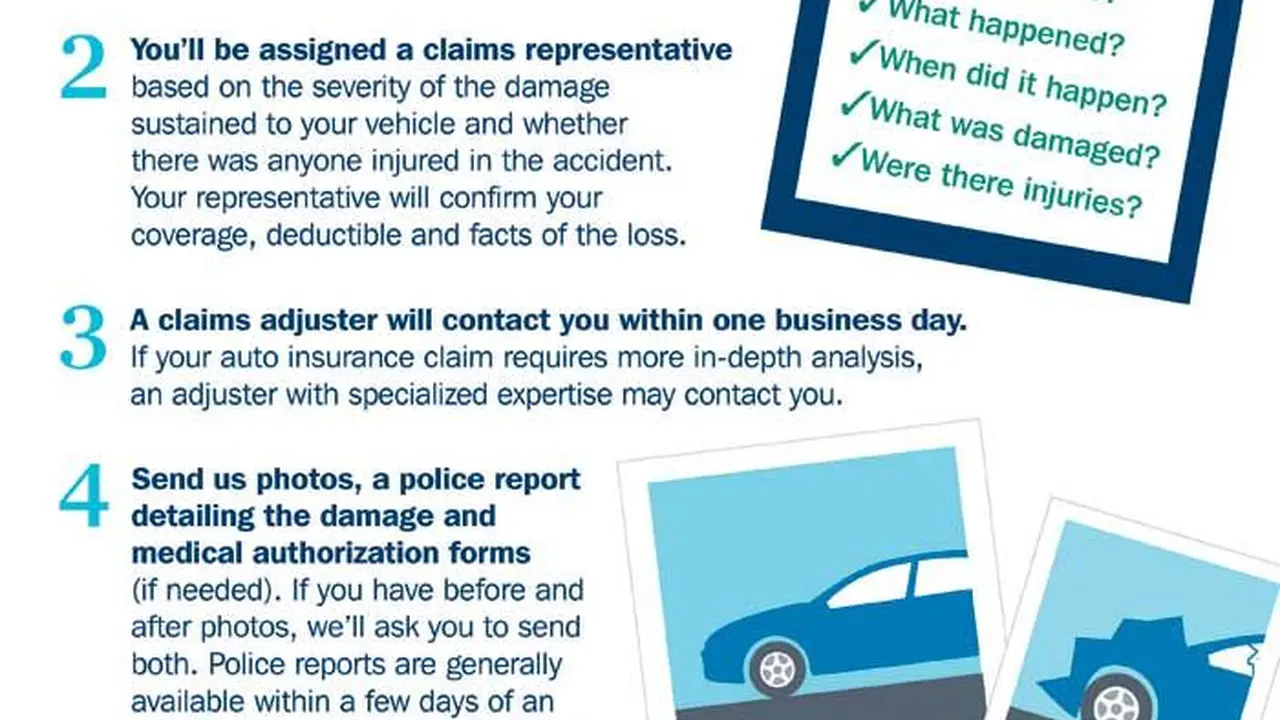

Your insurance company will assign you a claims adjuster who will investigate the accident and handle your claim. Be prepared to answer their questions and provide them with any documentation they request, such as photos, police reports, and medical records.

Step 5 Cooperate with the Claims Adjuster The Investigation Process

The claims adjuster will conduct a thorough investigation to determine the cause of the accident and who was at fault. This may involve:

- Reviewing the police report.

- Interviewing you, the other driver(s), and any witnesses.

- Inspecting the damage to the vehicles.

- Consulting with accident reconstruction experts.

Cooperate fully with the claims adjuster and provide them with all the information they need. Be honest and accurate in your statements, and avoid speculating or admitting fault. Remember, anything you say can be used against you in the claims process.

Step 6 Get an Estimate for Repairs and Car Damage Assessment

Once your insurance company has approved your claim, you'll need to get an estimate for the repairs to your vehicle. You can typically get an estimate from a repair shop of your choice, or your insurance company may have a preferred network of repair shops. If you choose your own repair shop, make sure they are reputable and experienced in repairing vehicles like yours. Get a detailed written estimate that includes a breakdown of all the costs involved, such as parts, labor, and paint. Present your estimate to the claims adjuster, who will review it and determine if it's reasonable. If there are any discrepancies, they may negotiate with the repair shop to reach an agreement.

Step 7 Consider a Rental Car and Understand Car Rental Insurance Coverage

If your car is undrivable, you may be entitled to a rental car while it's being repaired. Check your insurance policy to see if you have rental car coverage. If you do, your insurance company will typically pay for a rental car for a specified period of time.

When renting a car, you'll be offered various types of rental car insurance. Before purchasing any additional coverage, check your existing auto insurance policy and credit card benefits to see if you're already covered. You may be able to save money by declining the rental car company's insurance options.

Step 8 Negotiate a Settlement and Understand Your Rights

Once the repairs to your vehicle are complete, or if your car is totaled, your insurance company will offer you a settlement. The settlement should cover the cost of repairs, rental car expenses (if applicable), and any other damages you're entitled to under your policy.

Review the settlement offer carefully and make sure it's fair. If you're not satisfied with the offer, you have the right to negotiate with the insurance company. Provide them with any additional documentation or evidence that supports your claim.

If you're unable to reach a settlement with the insurance company, you may have the option of filing a lawsuit. However, this should be considered a last resort, as it can be a lengthy and expensive process.

Step 9 Release of Liability and Final Steps

Once you've reached a settlement agreement with the insurance company, you'll be asked to sign a release of liability. This document releases the insurance company from any further claims related to the accident. Read the release carefully before signing it, and make sure you understand its terms.

After signing the release, you'll receive a payment from the insurance company. This payment may be made directly to you or to the repair shop, depending on the agreement. Once you've received the payment, you can close your claim and move on.

Specific Product Recommendations for Car Accident Documentation

Here are a few products that can help you document a car accident effectively:

- Smartphone with a good camera: Most smartphones have excellent cameras that can capture high-quality photos and videos.

- Dashcam: A dashcam can automatically record video footage of your driving, which can be invaluable in proving fault in an accident.

- Accident Report App: There are several accident report apps available for smartphones that can guide you through the documentation process and help you gather the necessary information.

- Voice Recorder: Use the voice recording app on your phone to dictate the scene. This can be helpful for quickly capturing details when you don't have time to write them down.

Product Comparison and Pricing

Let's compare a few popular dashcams:

| Product | Features | Price (Approximate) | Use Case |

|---|---|---|---|

| Garmin Dash Cam 67W | Wide 180-degree view, GPS, voice control | $250 | General use, good for capturing a wide view of the road |

| Nextbase 622GW | 4K recording, image stabilization, emergency SOS | $400 | High-quality video, advanced safety features |

| Vantrue N4 | Triple channel recording (front, interior, rear), night vision | $300 | Uber/Lyft drivers, comprehensive coverage |

Remember to research and compare prices from different retailers before making a purchase.

Key Takeaways and Safety Tips

Filing a car insurance claim can be a complex process, but by following these steps, you can navigate it with confidence. Remember to prioritize safety, document the scene thoroughly, and cooperate with your insurance company. By being prepared and informed, you can ensure a fair and efficient claims process.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)