HMO vs. PPO: Which Health Plan Is Right for You?

Understanding the key differences between HMOs and PPOs, including cost, flexibility, and access to specialists. Choose the plan that best fits your healthcare needs. HMOs and PPOs are two common types of health insurance plans.

What are HMO Health Insurance Plans

HMO stands for Health Maintenance Organization. These plans typically require you to choose a primary care physician (PCP) who acts as your main point of contact for all your healthcare needs. You usually need a referral from your PCP to see a specialist, except in emergencies. HMOs often have lower premiums and out-of-pocket costs compared to PPOs, but they offer less flexibility in choosing your doctors.

HMO Cost Considerations Premiums Copays and Deductibles

HMOs are generally known for their cost-effectiveness. Premiums are usually lower than those of PPO plans. Copays, the fixed amount you pay for each doctor visit or prescription, tend to be lower as well. However, some HMO plans may have a deductible, the amount you pay out-of-pocket before your insurance starts covering costs.

HMO Flexibility and Doctor Choice Considerations

The main drawback of HMOs is their limited flexibility. You're typically restricted to a network of doctors and hospitals. Going outside the network usually means you'll have to pay the full cost of the care. Also, the requirement of a PCP referral to see a specialist can sometimes delay access to specialized care.

HMO Usage Scenarios When is an HMO the Right Choice

HMOs are a good choice for individuals and families who prioritize lower costs and don't mind having a primary care physician coordinate their care. They're also suitable for people who don't need frequent access to specialists and are comfortable staying within a specific network of providers. If you’re relatively healthy and don’t anticipate needing specialized care often, an HMO could save you money.

What are PPO Health Insurance Plans

PPO stands for Preferred Provider Organization. PPO plans offer more flexibility than HMOs. You can see any doctor or specialist you want without a referral. While you'll pay less if you see doctors within the PPO network, you're also covered if you go out-of-network, although at a higher cost. PPOs generally have higher premiums and out-of-pocket costs compared to HMOs.

PPO Cost Considerations Premiums Deductibles and Out of Pocket Maximum

PPO plans typically have higher premiums than HMOs. You'll also likely have a higher deductible, meaning you'll pay more out-of-pocket before your insurance kicks in. However, PPOs often have an out-of-pocket maximum, which limits the total amount you'll pay for covered healthcare services in a year. Even though the upfront costs might be higher, this maximum can provide peace of mind if you anticipate needing significant medical care.

PPO Flexibility and Specialist Access

The biggest advantage of PPOs is their flexibility. You don't need a referral to see a specialist, and you can choose any doctor you want, whether they're in or out of the network. This is particularly beneficial if you have a chronic condition that requires regular visits to specialists or if you prefer to have a wide range of doctors to choose from.

PPO Usage Scenarios When Does a PPO Make Sense

PPOs are a good choice for individuals and families who value flexibility and want the freedom to choose their doctors without a referral. They're also suitable for people who need frequent access to specialists or who prefer to have coverage even when seeing out-of-network providers. If you are ok with paying more for your monthly premiums in order to have a larger network of doctors and specialists, a PPO may be for you.

HMO vs PPO A Detailed Comparison

Let's break down the key differences between HMOs and PPOs in a table:

| Feature | HMO | PPO |

|---|---|---|

| Premiums | Lower | Higher |

| Deductibles | Lower (sometimes none) | Higher |

| Copays | Lower | Higher |

| Referrals to Specialists | Required | Not Required |

| In-Network Coverage | Covered | Covered |

| Out-of-Network Coverage | Generally Not Covered (except emergencies) | Covered (at a higher cost) |

| Flexibility | Lower | Higher |

Specific Health Insurance Product Recommendations

Keep in mind that availability and specific plan details vary by location. Always check with the insurance company directly or use a reputable insurance comparison website to get accurate quotes and plan information for your area.

Kaiser Permanente HMO A Popular Choice for Integrated Care

Kaiser Permanente is a well-known HMO that offers integrated care, meaning that its doctors, hospitals, and pharmacies are often located in the same facilities. This can lead to better coordination of care and a more streamlined experience. Kaiser Permanente often receives high ratings for customer satisfaction. Price range: Premiums typically range from $400-$800 per month for an individual, depending on the specific plan and location.

Blue Cross Blue Shield PPO A Wide Network of Providers

Blue Cross Blue Shield offers a variety of PPO plans with a wide network of doctors and hospitals across the United States. This makes it a good choice for people who travel frequently or want the flexibility to see doctors in different locations. Price range: Premiums typically range from $500-$900+ per month for an individual, depending on the specific plan and location.

UnitedHealthcare PPO A National Provider with Many Options

UnitedHealthcare is another major health insurance provider with a large selection of PPO plans. They offer a variety of options to suit different needs and budgets. They are also known for their online resources and tools. Price range: Premiums typically range from $550-$1000+ per month for an individual, depending on the specific plan and location.

Cigna PPO Focusing on Preventative Care

Cigna provides PPO plans that focus on preventative care and wellness programs. They offer various digital health tools and resources to help members manage their health. Their plans are known for comprehensive coverage options. Price range: Premiums typically range from $520-$950+ per month for an individual, depending on the specific plan and location.

Comparing Health Insurance Products How to Choose the Right Plan

Choosing the right health insurance plan involves considering several factors:

- Your Budget: How much can you afford to pay in premiums, deductibles, and copays?

- Your Healthcare Needs: Do you need frequent access to specialists? Do you have any chronic conditions?

- Your Preferred Doctors: Are your preferred doctors in the network of the plan you're considering?

- Your Risk Tolerance: Are you comfortable with the limitations of an HMO in exchange for lower costs, or do you prefer the flexibility of a PPO even if it means paying more?

Health Insurance Product Pricing Considerations

The cost of health insurance can vary significantly depending on your age, location, health status, and the specific plan you choose. It's essential to get quotes from multiple insurance companies and compare the costs and benefits of different plans before making a decision. Also, remember to factor in not just the premium but also the potential out-of-pocket costs, such as deductibles, copays, and coinsurance.

Health Insurance Plan Selection Usage Scenarios

Here are a few scenarios to illustrate when an HMO or PPO might be a better fit:

- Scenario 1: A young, healthy individual with no chronic conditions who rarely sees a doctor might benefit from an HMO with lower premiums.

- Scenario 2: A person with a chronic condition who needs regular visits to a specialist should consider a PPO to avoid the need for referrals.

- Scenario 3: A family with young children who need frequent checkups and vaccinations might find a PPO more convenient, as they can see any pediatrician without a referral.

- Scenario 4: Someone who travels frequently might prefer a PPO with a broad national network.

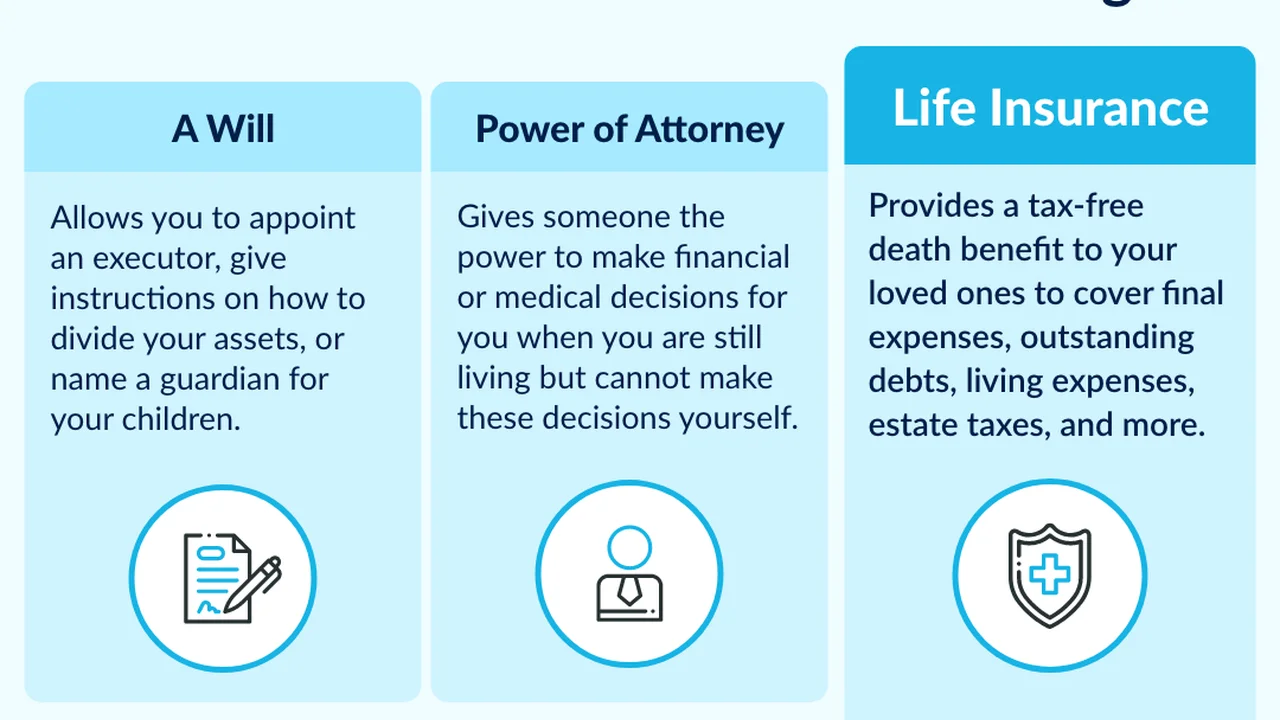

The Importance of Health Insurance Understanding the Benefits

Health insurance is an essential investment in your health and financial well-being. It can protect you from the high cost of medical care and ensure that you have access to the healthcare you need when you need it. While it can be tempting to skip health insurance to save money, the potential financial consequences of a serious illness or injury can be devastating. Investing in the right health insurance plan can provide peace of mind and protect your future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

: Enrollment and Coverage.webp)